Non-document verification

Offer users an easy sign-up that’s compliant with global KYC/AML regulation and optimized for frictionless conversions.

Top companies switch to Incode for our proven impact on fraud protection and growth

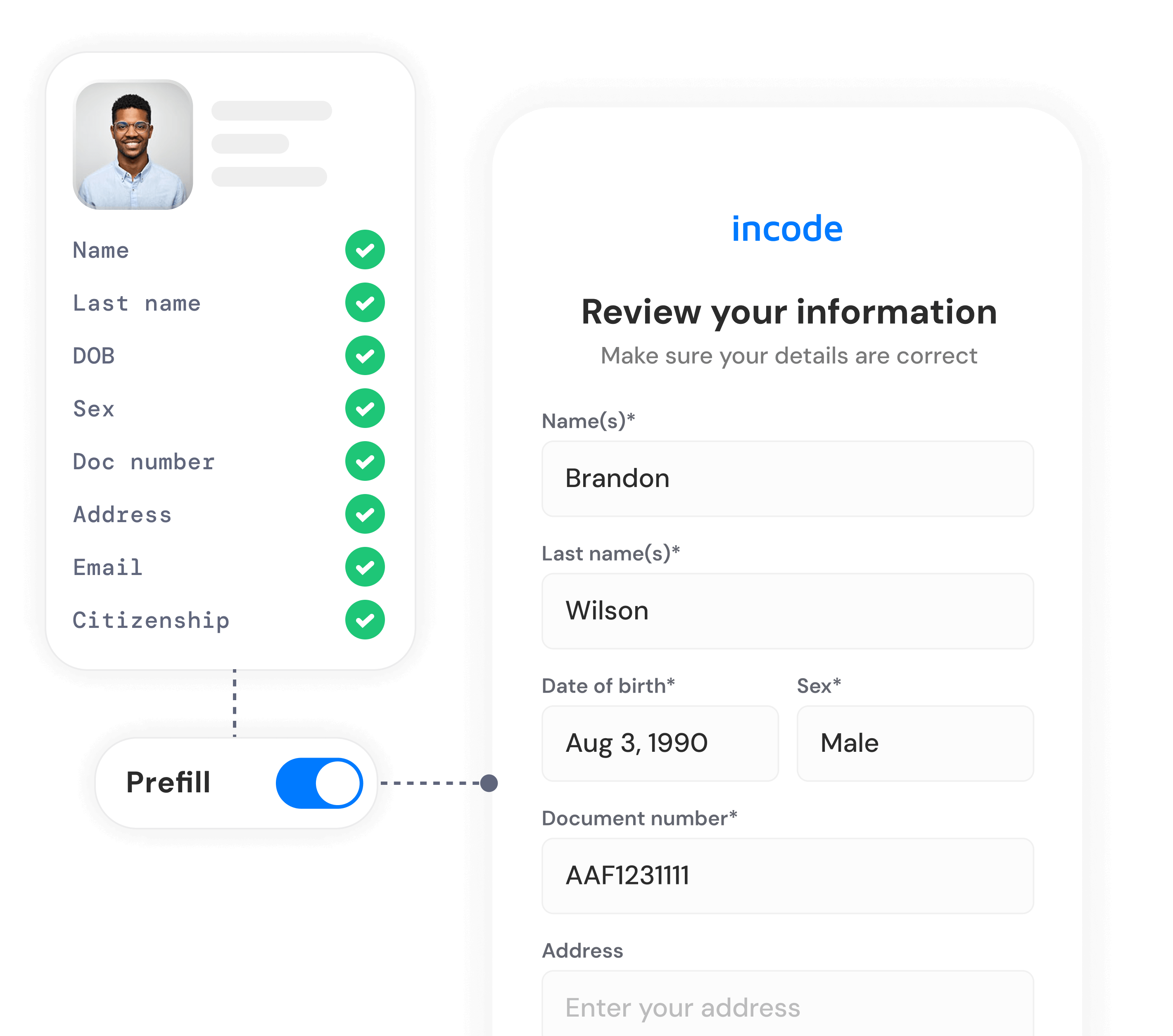

Minimize drop offs

with auto-form fill and fuzzy matching

Automate identity checks to minimize friction while still meeting minimum regulatory verification requirements.

Improve pass rates with configurable logic and fraud risk signals

Onboarding is dynamic based on a user’s risk profile, using both identity-based and passive risk signals that don’t require low-risk users to provide unnecessary information

Identity-based

Verifying customer identity by referencing trusted data sources

Device risk signals

Examining characteristics associated with fraud, such as hardware

Network risk signals

Cross-checking IP address, geolocation, VPNs, and more for legitimacy

Access the largest global network of authoritative databases

Explore our network of multi-source attribute verification for unmatched

accuracy and coverage

Databases

National, State and Local

Large, centralized repositories of information, often organized by specific categories (e.g. Social Security numbers (SSN), credit history).

eCBSV

Electronic Consent Based Social Security Verification

This service allows authorized parties to confirm a person’s SSN, name, date of birth (DOB) with the Social Securities Administration’s database.

AAMVA

American Association of Motor Vehicle Administrators

The organization facilitates the verification of driver’s license and motor vehicle registration data across state DMVs.

TIN

Taxpayer Identification Number

The IRS’s database of TINs that includes SSNs, Employer Identification Numbers (EINs), and other tax-related identifiers.

Credit Bureaus

Private companies we integrate with that collect and maintain consumer credit history.

Telcos

Large number of Telco companies that verify phone numbers and addresses.

Operate across borders with confidence.

Simplified global compliance.

Incode continuously monitors and screens against global sanctions, watchlists, and Politically Exposed Persons (PEP) while you focus on your business.

Custom onboarding based on your requirements and users’ risk profile

Pre-built templates

Select from a library of pre-built modules for KYC, Kantara-Compliant, Age Verification, AML and more.

Adaptive user paths

Offer customized onboarding and low friction verifications for low-risk users, with 99% of users validated in seconds and on their first try