Financial Services

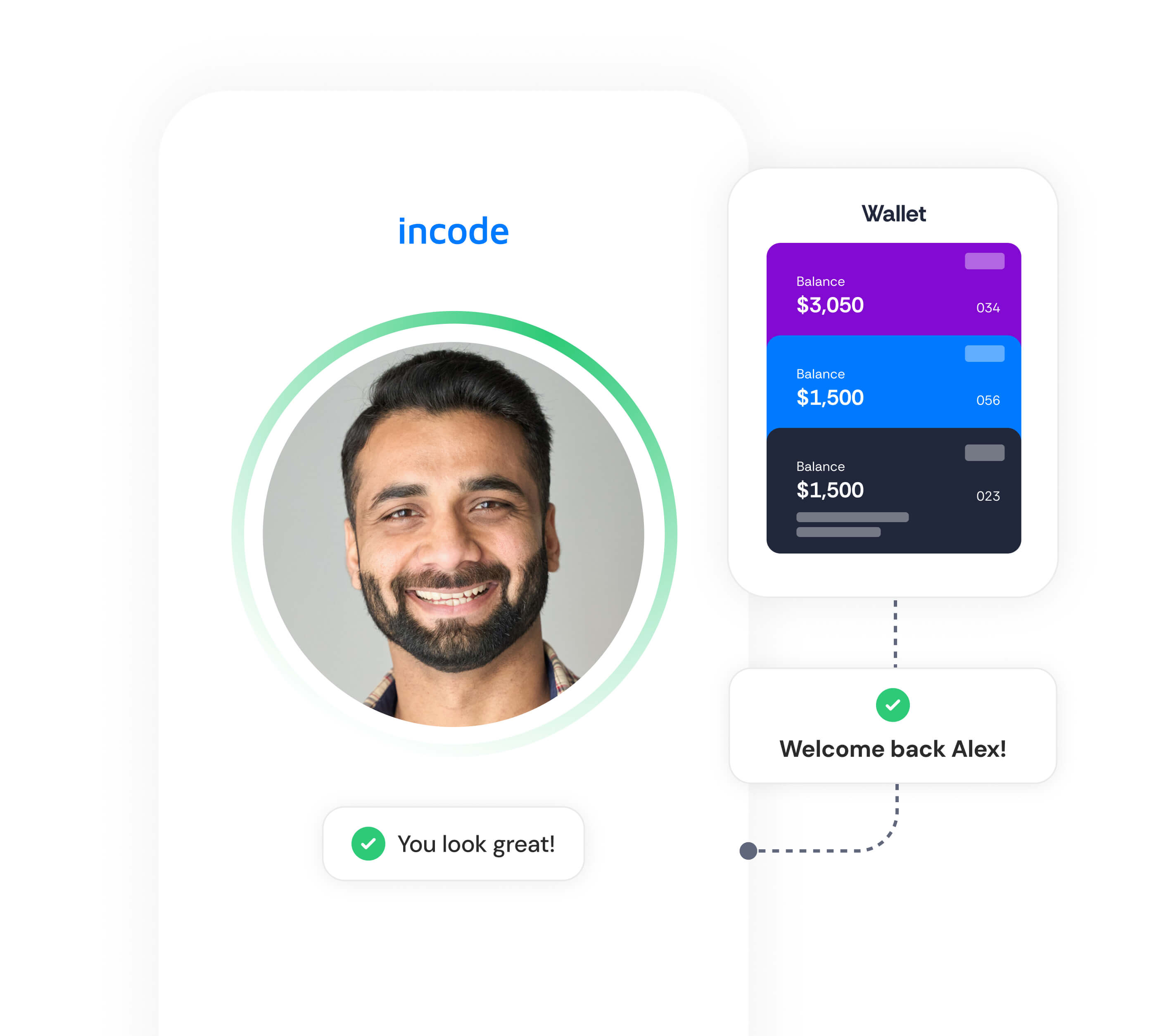

Tired of onboarding bottlenecks, manual reviews, fraud losses, and frustrated customers? Our end-to-end identity verification platform, purpose-built for financial services, guarantees compliance while delivering a top-notch user experience.

Top companies switch to Incode for our proven impact on fraud protection and growth

Verify identities from 220+ countries & territories

Automate compliance, not just onboarding with our AI-powered platform.

- Verify users with authoritative KYC/AML data sources to streamline customer due diligence (CDD) and enhanced due diligence (EDD) processes.

- Build dynamic workflows that adapt to evolving regulatory requirements in different markets, mitigating compliance risk without adding friction.

Stay ahead of sophisticated financial crime

Don’t let deepfakes, social engineering, and other advanced fraud tactics compromise your security. Our AI-powered orchestration platform empowers you with real-time risk assessment, and adaptive authentication measures to proactively identify and mitigate threats.

Accuracy, efficiency, and trust:

the Incode advantage

Accuracy

Industry-leading 99%+ accuracy in face matching, passive liveness detection, and document validation ensures reliable identity verification.

Efficiency

Streamline onboarding and reduce manual reviews with automated workflows and intelligent decisioning.

Trust

We define success by your standards, committing to tangible metrics that reflect your objectives in fraud reduction and user conversion.

ROI

Our guarantees are as robust as our technology. Expect measurable value that upholds our commitment to excellence.

Hear it from our customers

A full suite of identity solutions for Financial Services

Fight all types of financial fraud, from onboarding to account takeover

IDV

Automate customer onboarding and streamline compliance.

Non-Doc Verification

Streamline digital identity verification by securely confirming users’ identities without requiring physical documents.

KYB

Streamline business verification and beneficial owner checks.

Workforce

Face factor authentication (FFA) to help employees verify their identities

Age Verification

Ensure compliance with age-restricted products and services.

Telcos

Proactively detect and prevent suspicious activity.

Future-proof

your

identity infrastructure

Our developer-friendly SDK and API seamlessly integrate with your existing technology stack, empowering you to leverage the power of Incode’s identity verification features within your own applications. This allows for a smooth integration process with minimal disruption to your current workflows, and ensures that you can scale your identity verification capabilities as your needs evolve.

Precision, speed, and security:

the Incode difference

Outperform your current provider with measurable results

Unmatched Accuracy

Our proprietary AI algorithms, trained on millions of diverse identities and documents, consistently deliver the highest accuracy rates in the industry.

Superior OCR &

Barcode Reading

Capture and extract data from 25% more documents than competitors, ensuring seamless onboarding even with challenging documents.

KYB

Verify liveness without interrupting the user experience, significantly reducing drop-off rates and accelerating onboarding.

Advanced Fraud Prevention

Proactively detect deepfakes, synthetic identities, and evolving fraud patterns with our continuously updated in-house fraud lab.

Dedicated Support

Our team of identity experts provides personalized guidance and support, ensuring you get the most out of our platform.

Flexible Deployment

Choose from cloud-based or on-premise solutions to meet your specific security and infrastructure requirements.