Know Your

Business (KYB)

Our KYB solution acts as your digital doorman, verifying the legitimacy of businesses before you start working with them.

Top companies switch to Incode for our proven impact on fraud protection and growth

First impression matter

Make it easy for your B2B customers to get started – prevent fraud without putting undue friction on the businesses you onboard.

- Fully automated onboarding experience keeps you compliant and genuine business customers happy.

- Say goodbye to manual review of POA/LOA, we do this automatically without slowing down the onboarding.

- Run watchlists and sanction checks in seconds with smart document extraction and automated analysis.

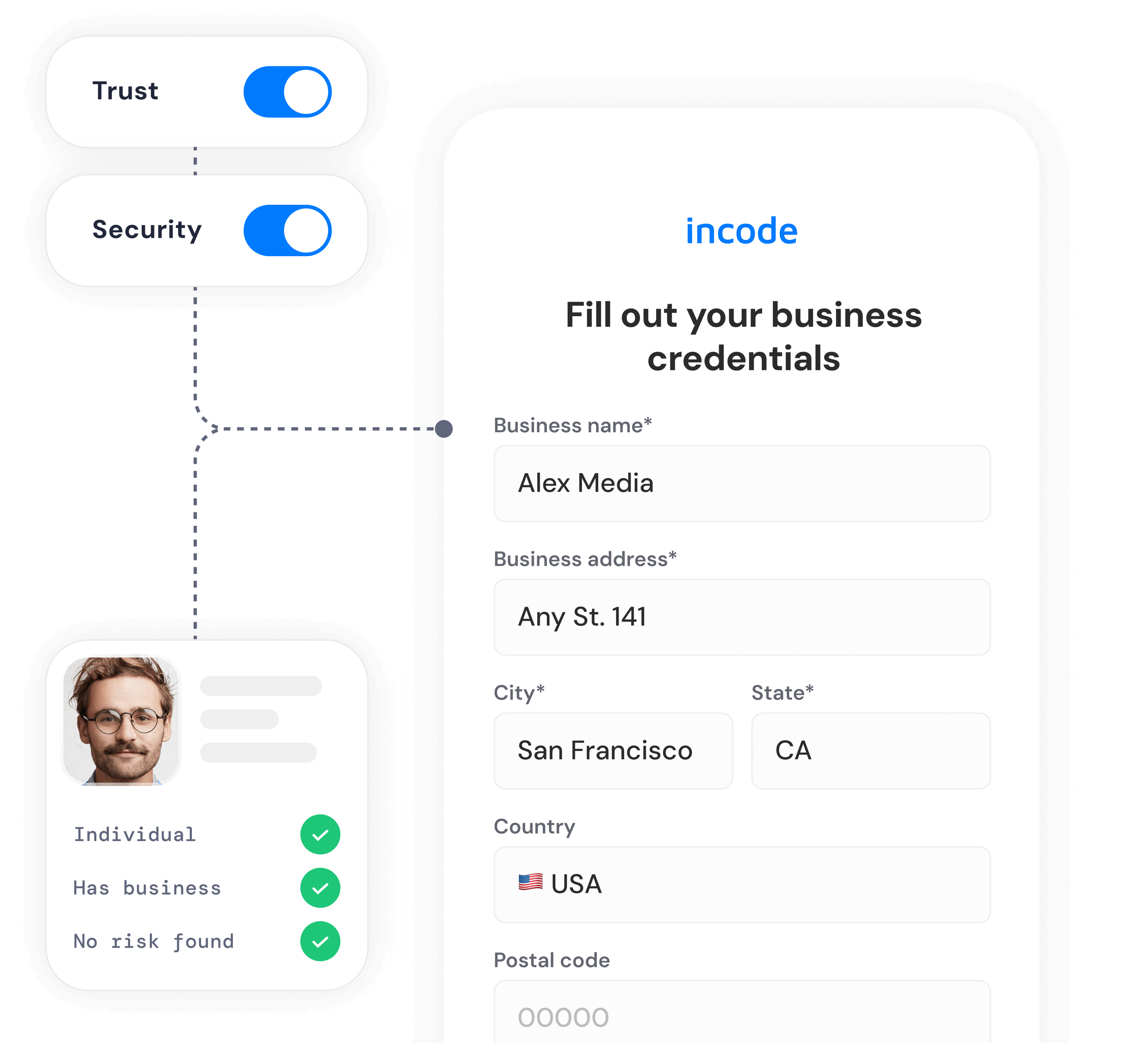

Proactive risk mitigation

Stop fraudulent accounts with comprehensive KYB checks.

Tax ID number

Ensure valid TIN/EIN, with alternative name possibilities.

Watchlists screening

Check against government sanctioned watchlists, including OFAC.

People matching and UBO

Identify UBOs and understand which people are associated with each business.

Shell company alerts

Check reputable databases and watchlists to flag potential shell companies by cross-referencing against known lists, identifying suspicious registration patterns, and uncovering hidden beneficial ownership.

Inconsistent information flags

Automatically cross-checks information for discrepancies in names, addresses, dates, or other key identifiers.

Negative news or adverse media checks

Scour news sources, regulatory databases, and sanction lists for negative information associated with a business entity.

Global reach, local compliance.

Verify businesses and expand into new

markets across the globe

100% of IRS registered businesses in the US are covered with global database coverage in over 200+ countries.

Couple with our Non-Doc Verification of UBOs to verify businesses and their high-level employees

Stay compliant with fast, efficient, fully automated KYB + KYC database checks

Verify beneficiaries with all the needed KYC checks to prevent fraud

Get up and running quickly with Incode’s flexible API and developer-friendly documentation

Our flexible API, developer-friendly documentation, and dedicated support team streamline the implementation process, minimizing the time and resources needed to deploy powerful business verification.