Fraud Prevention Solutions

Keep up with fraud that

evolves at a light-speed pace

Verify identities with advanced AI-powered models that are trained with the most cutting-edge fraud

attacks, so you can confidently trust every new user and customer.

Top companies trust Incode for reliable fraud protection and enhanced security

Industry Insights

Today’s state of the fraud

industry

The fraud landscape is shifting to digital and GenAI, and as a result, it is intensifying rapidly. Over the next few years, businesses expect to face a surge in fraud, with projections indicating losses in the US and GenAI alone could enable $40 billion in losses by 2027.

Global drivers in today’s

rise in fraud

Fraud insights by industry

Fraud insights by region

The dynamic fight against fraud

Businesses who experienced a significant fraud attack suffer operational loss of revenue and reputational damages and may never

fully regain the eroded customer trust, leading to millions in long-term brand damage and potential regulatory penalties.

The exponential evolution

of fraud types

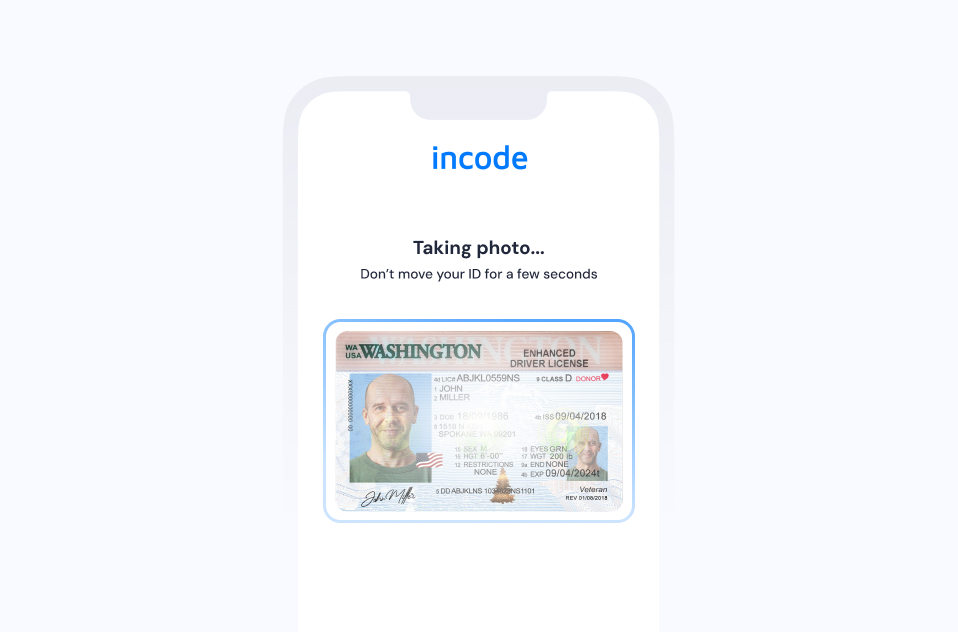

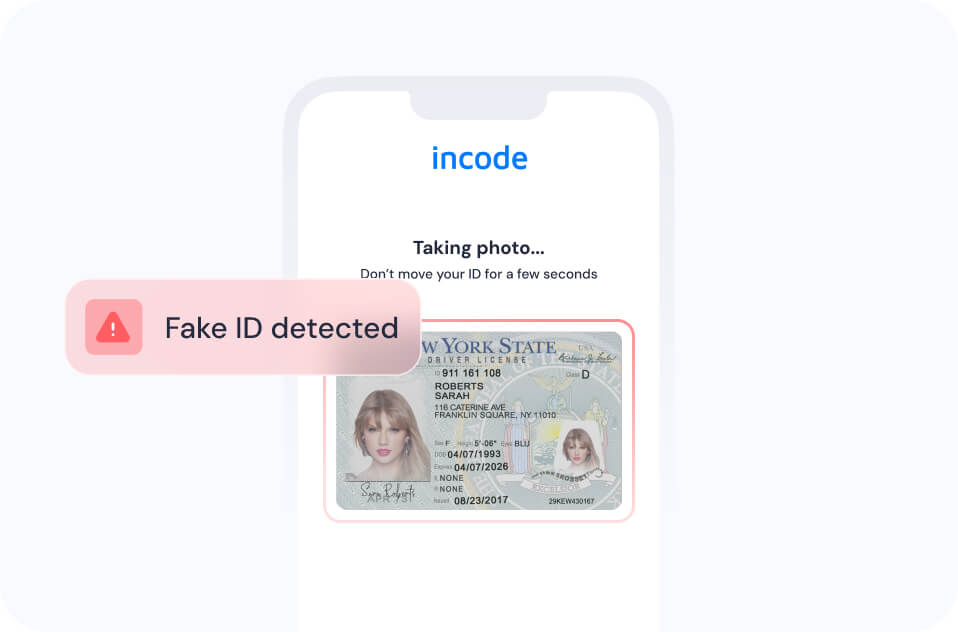

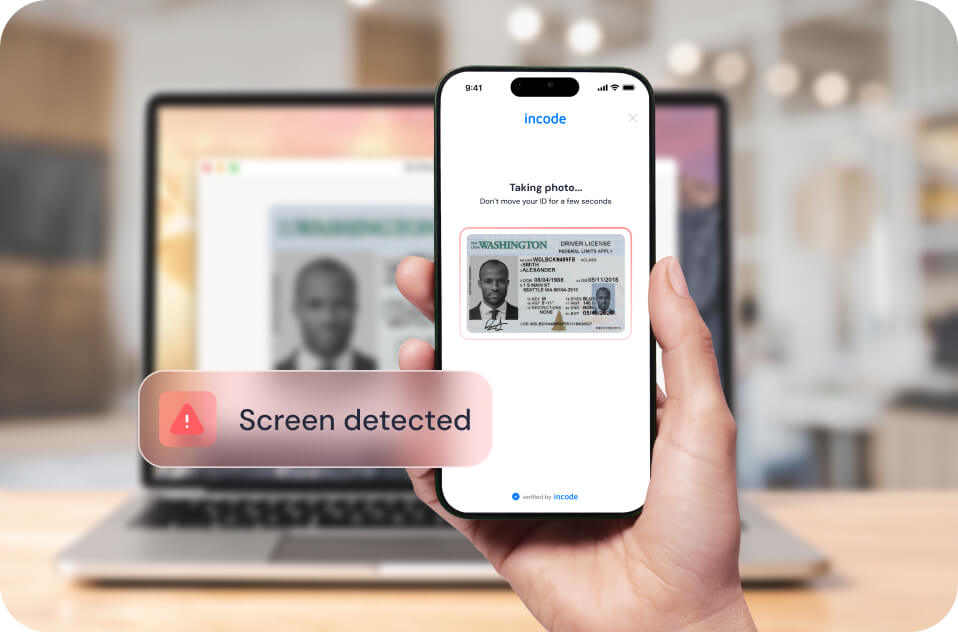

Screen Spoofing

Initially, fraudsters used small screen devices like phones and tablets for screen replays. However, as industry IDV presentation attack detection capabilities improved, attackers shifted to using higher-resolution captures from larger screens, with filters. This trend is in tandem with the rise of AI-generated IDs, often displayed off-screen to dodge detection. Incode’s technology has continuously adapted, advancing in step with these tactics to proactively counter increasingly complex attacks.

Paper-based Fraud

The trajectory of paper-based fraud has shown remarkable adaptability. In 2020, most paper spoofs involved basic photocopies. As industry IDV enhanced safeguards, fraudsters escalated their tactics to include more sophisticated colored cutout copies with high-quality prints on specialized paper designed to closely mimic authentic IDs. Each innovation by fraudsters pushes Incode to evolve, ensuring effective detection of even the most sophisticated forgeries.

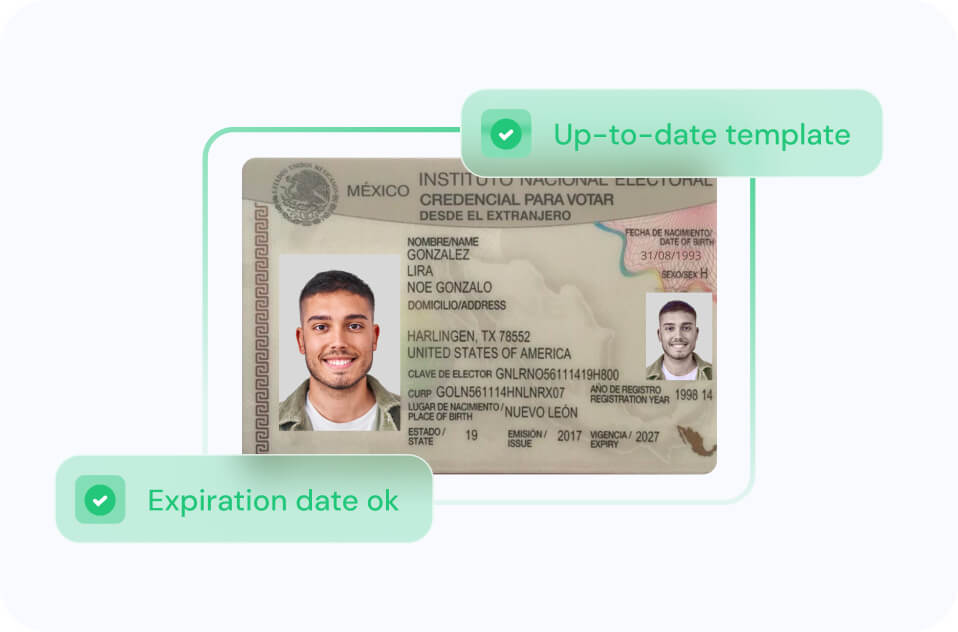

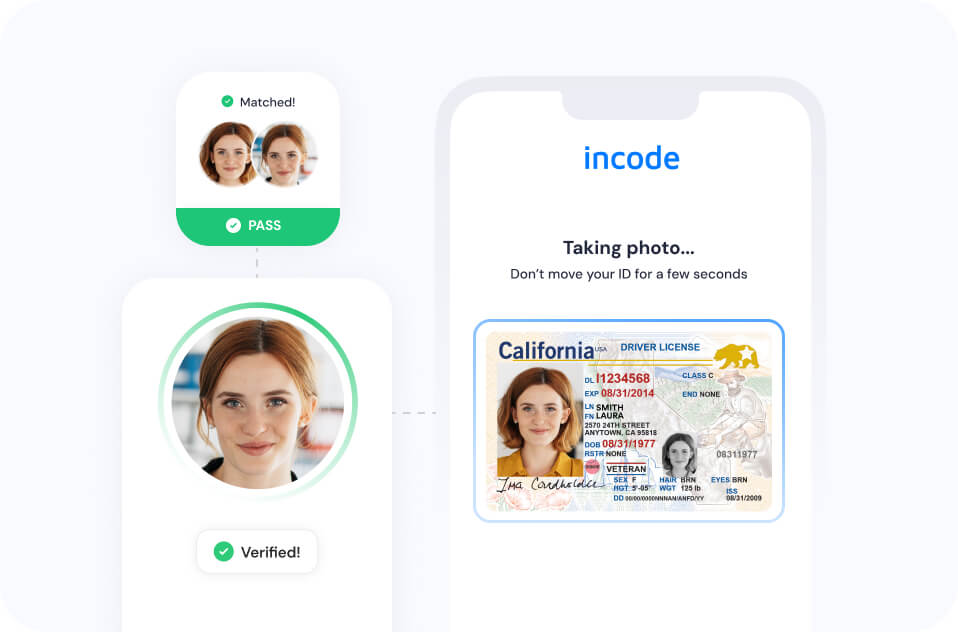

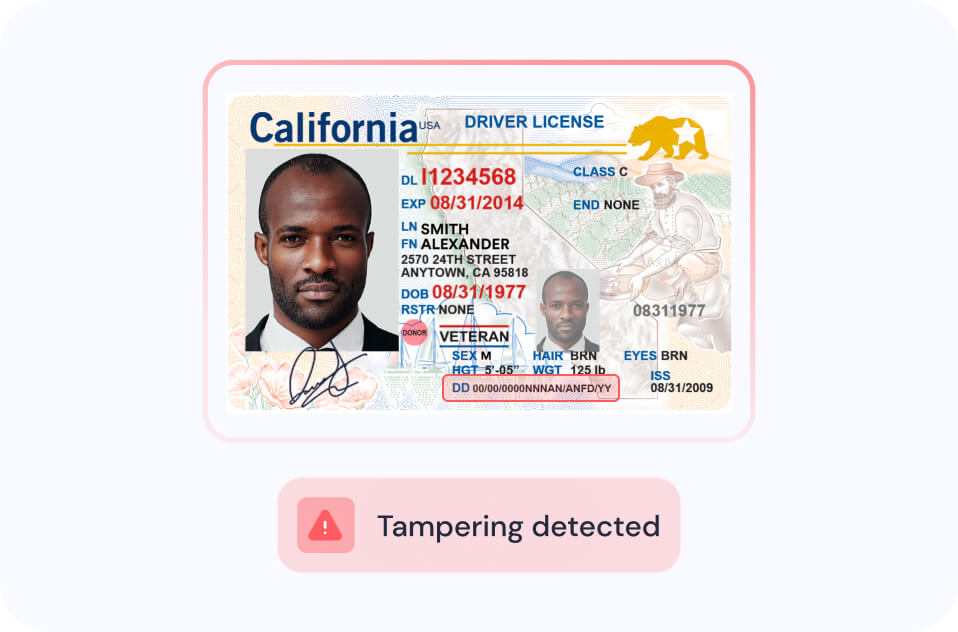

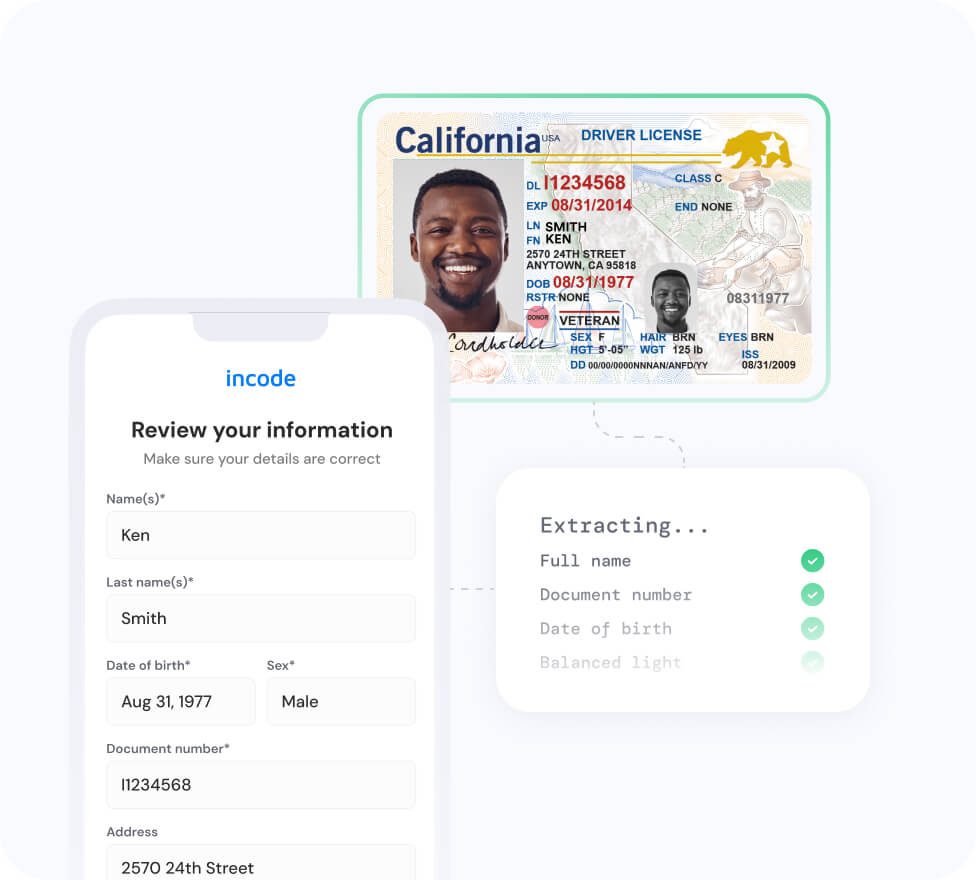

Digital manipulation and ID tampering

Fraudsters are increasingly turning to digital tools like Photoshop and other sophisticated AI tools to create tampered IDs, marking a significant shift towards digital manipulation. This evolution demands higher levels of precision and innovation. Incode is constantly adding new layers of security to detect the most subtle signs of tampering, ensuring consistent accuracy in identifying both physically and digitally manipulated IDs and executing crosschecks across multiple datapoints.

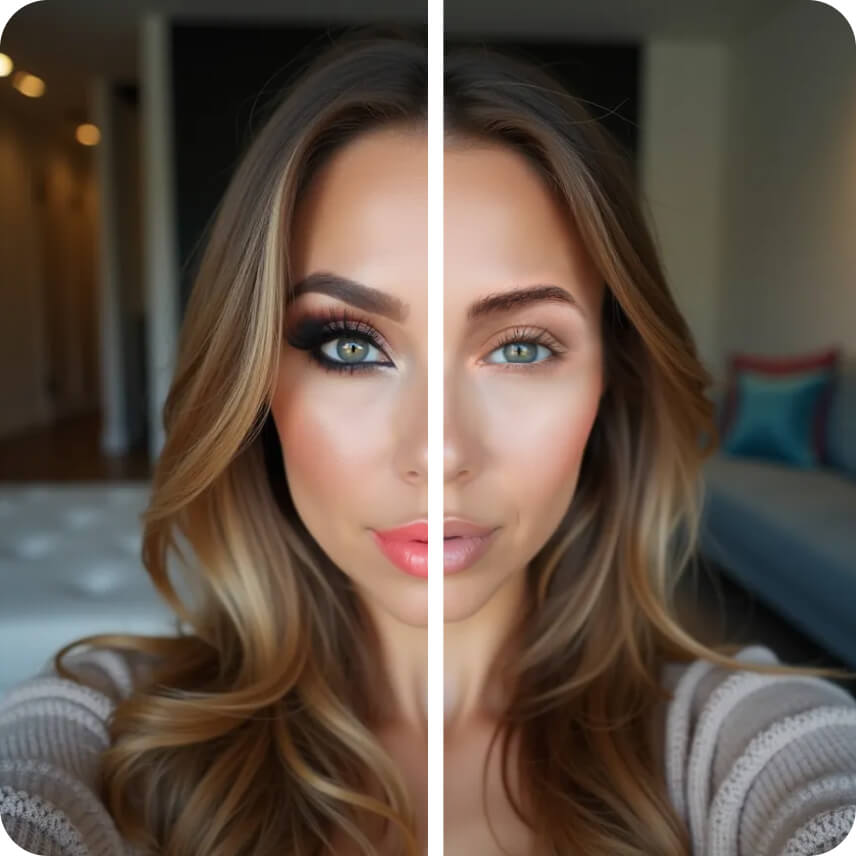

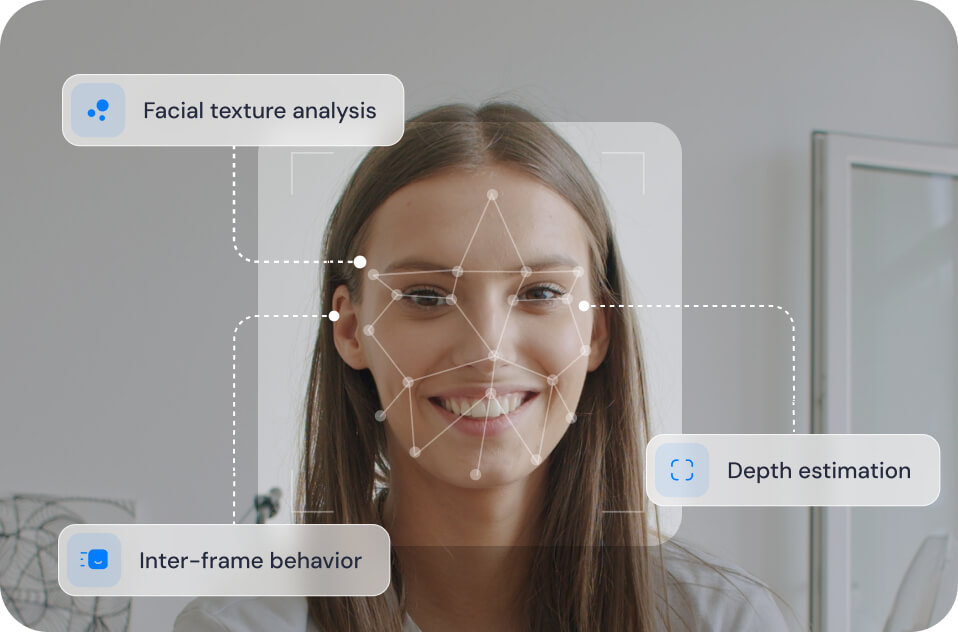

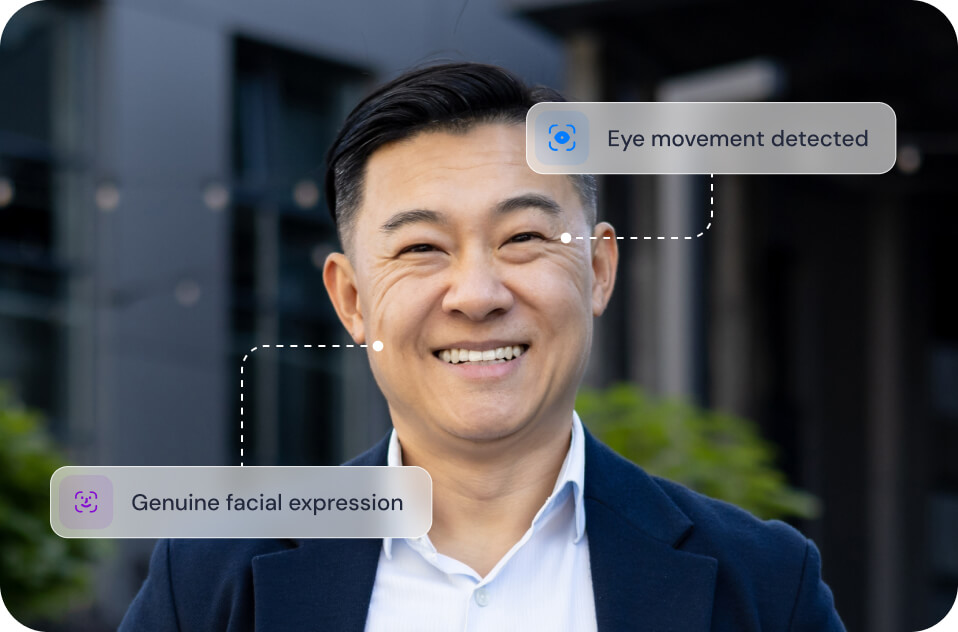

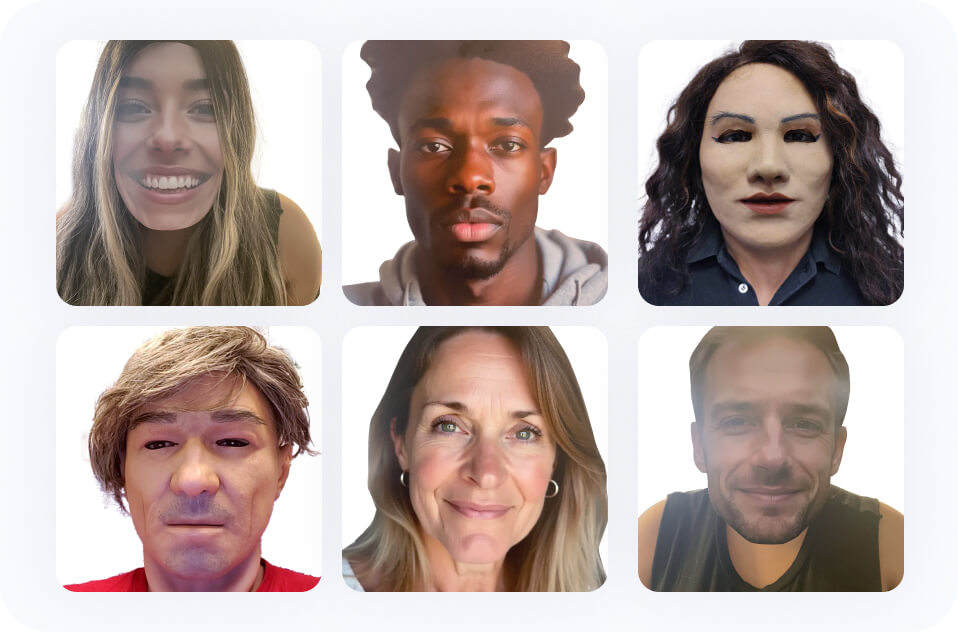

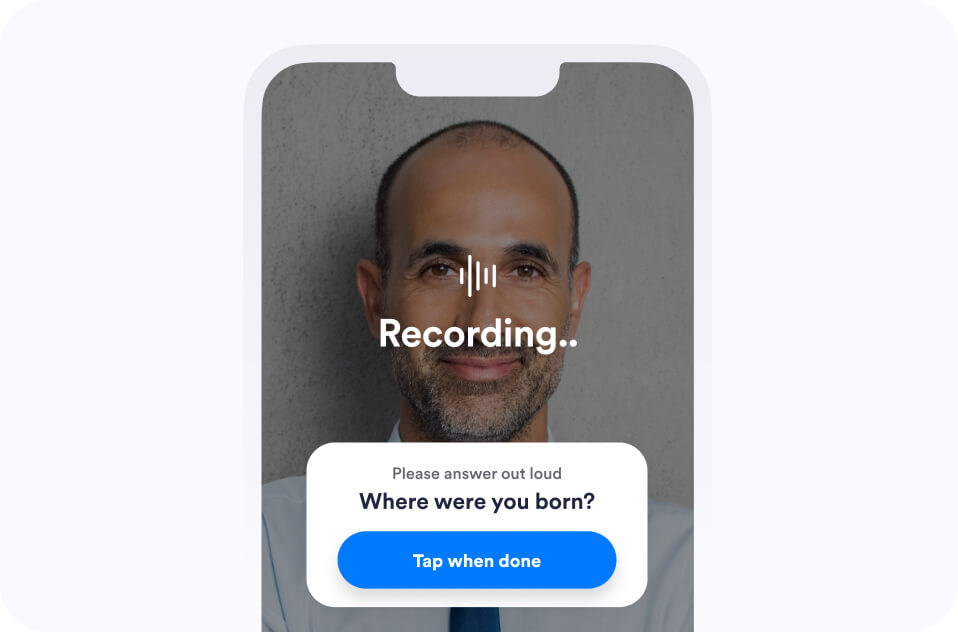

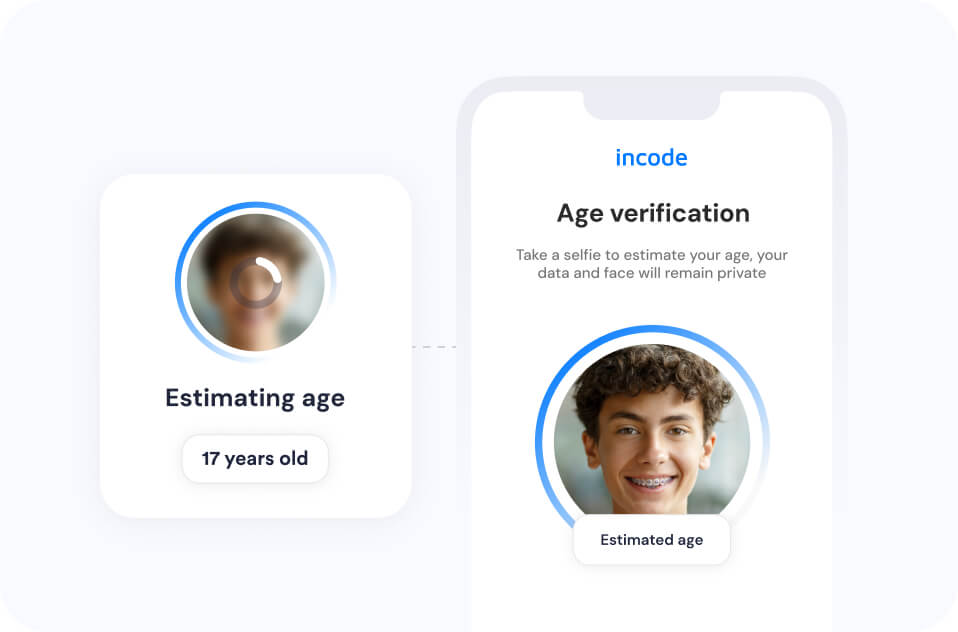

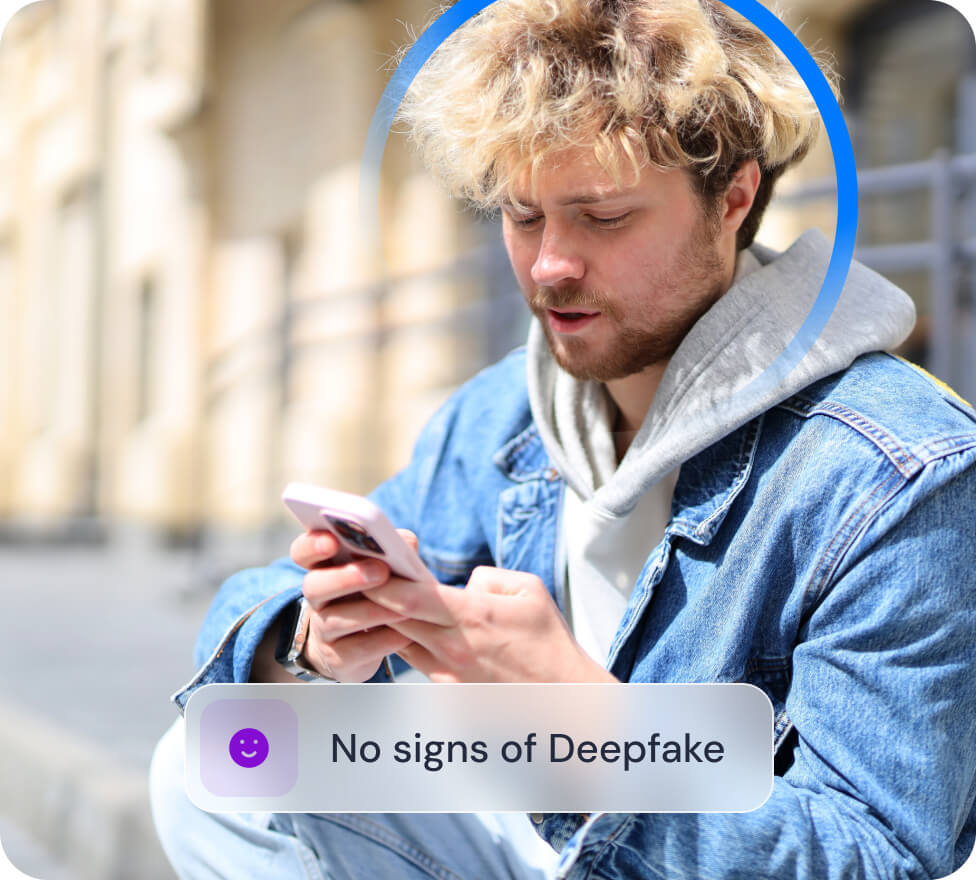

Biometric spoofing challenges with generative AI

Generative AI has introduced new complexities to facial recognition and liveness verification. Having triggered a surge in digitally created fake IDs, this new wave of AI-driven fraud poses significant challenges to the businesses Incode partners with. In response, we have intensified our training and focus increasingly on proof of personhood to ensure that the person behind the onboarding is a live person and is not using complex techniques enabled by generative AI, such as face swaps and morphs, which are some of the most rapidly growing fraud vectors.

Injection Attacks

A recent surge in injection attacks has been noted, where real or falsified data streams are injected directly into the communication channels between capture devices and biometric verification engines. Attackers use tools like emulators and virtual cameras to introduce counterfeit data streams that mimic authentic inputs. These sophisticated attacks demand advanced countermeasures to maintain the integrity of the identity verification process.

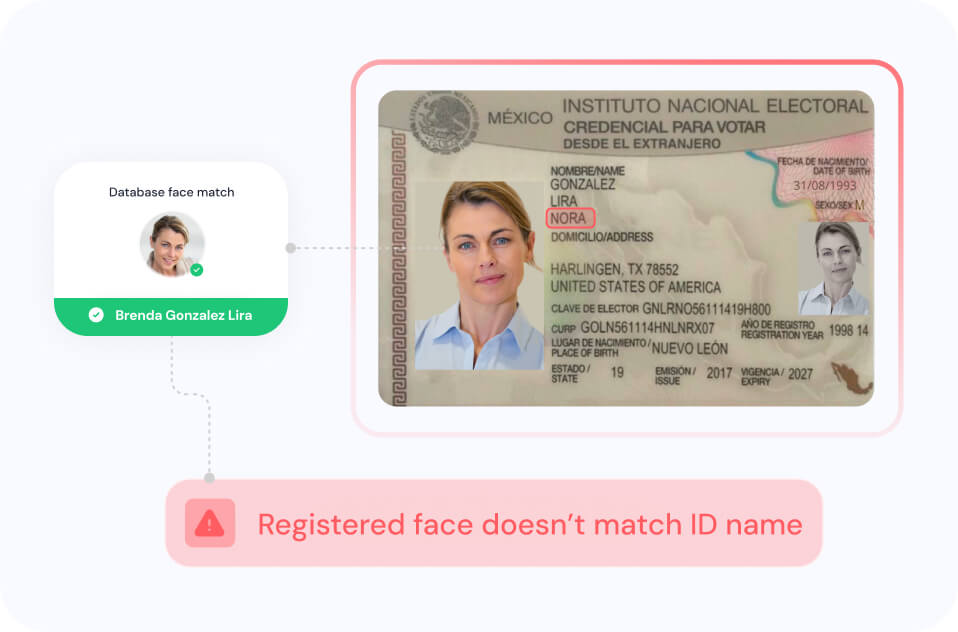

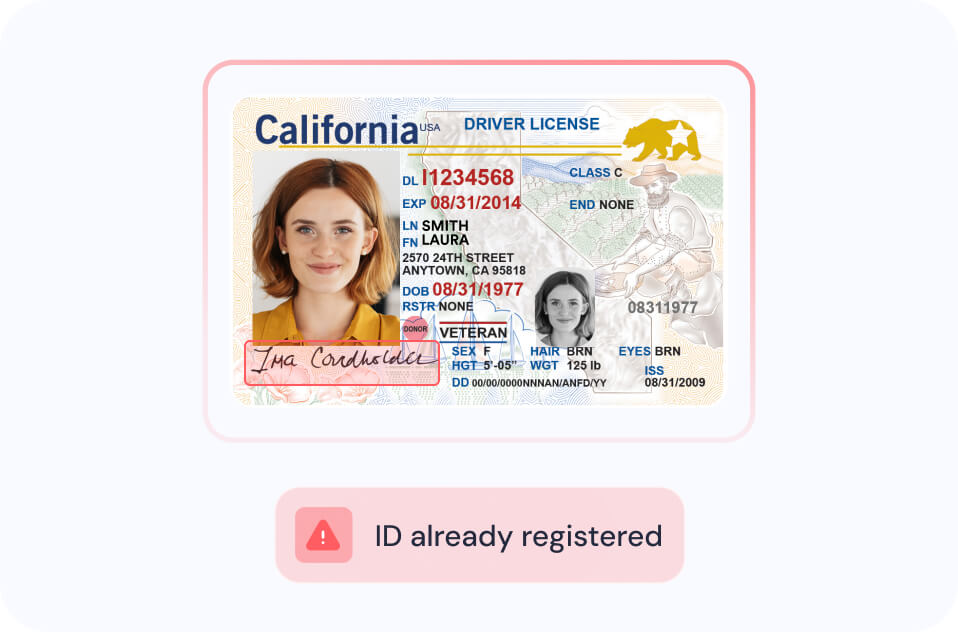

Persistent Threat of Serial Fraud

Serial fraud remains a persistent and popular threat, with attackers frequently reusing fraudulent identity elements across multiple attempts. This recurring pattern necessitates ongoing monitoring and comprehensive labeling to accurately identify repeat offenders and prevent further attacks. Incode’s antifraud compares selfies, portrait images and data points of all onboardings to detect common inconsistencies in serial fraud attacks.

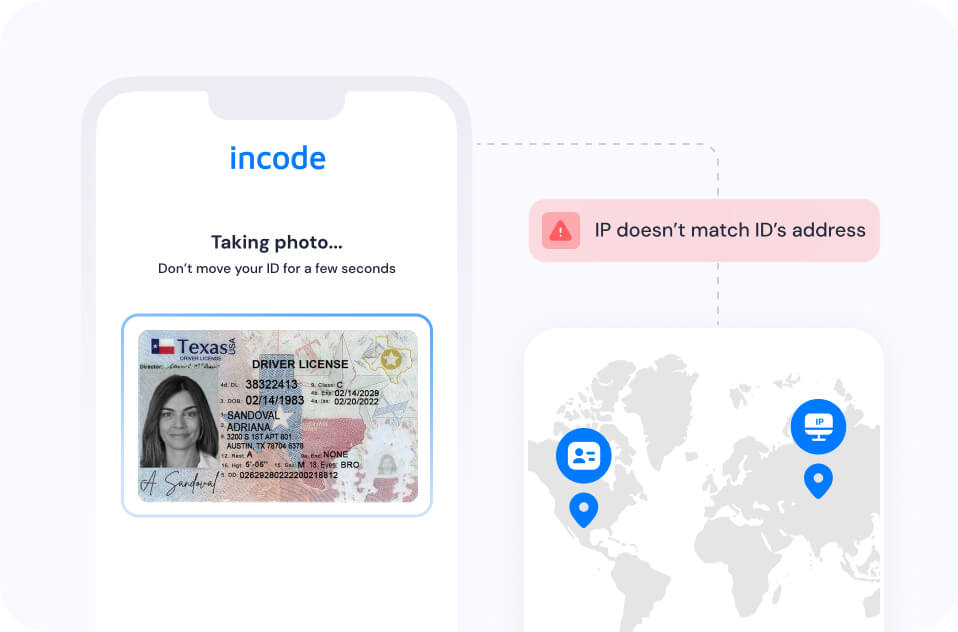

How Incode’s technology

prevents fraud

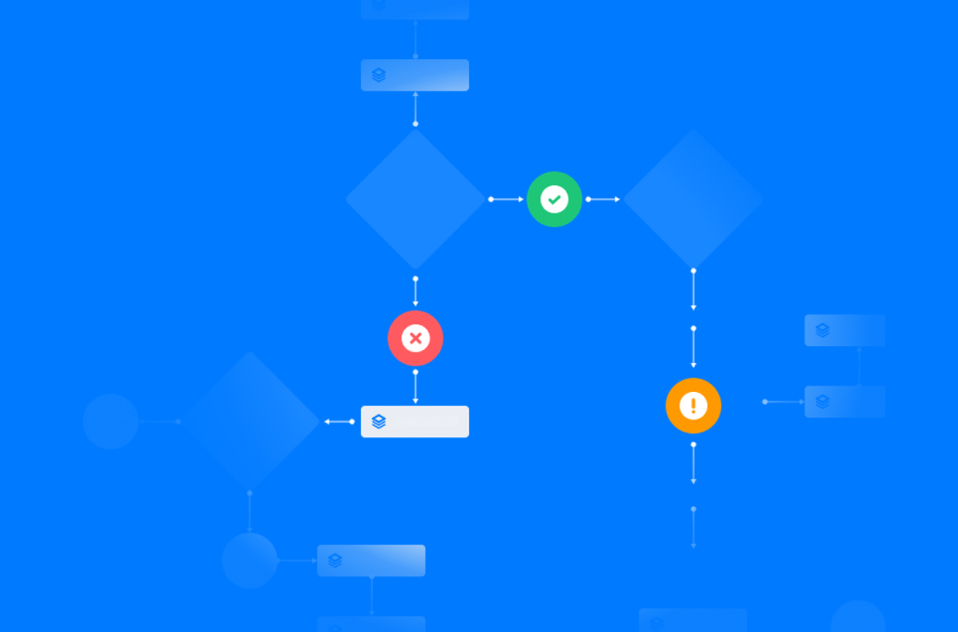

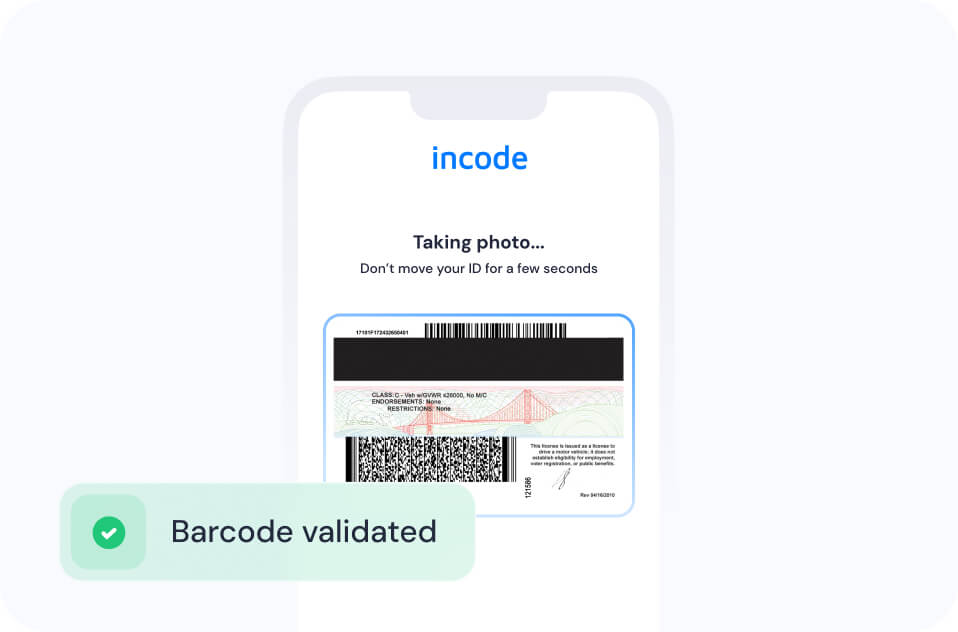

Here at Incode, we have developed over 35 proprietary machine-learning models that are trained by an in-house Fraud team to be on the cutting edge of the detection of over 100 distinct combinations of fraud techniques.

A proactive approach to studying and adapting rapidly against sophisticated and evolving fraud provides Incode’s partners with an unbreakable defense in a time when authenticity and security have never been more challenging and crucial to achieving.

Types of attacks

Explore the diverse tactics fraudsters use to exploit identity

systems and compromise security.

Our defenses

Discover how Incode’s advanced solutions safeguard businesses by detecting, preventing, and neutralizing fraud threats.

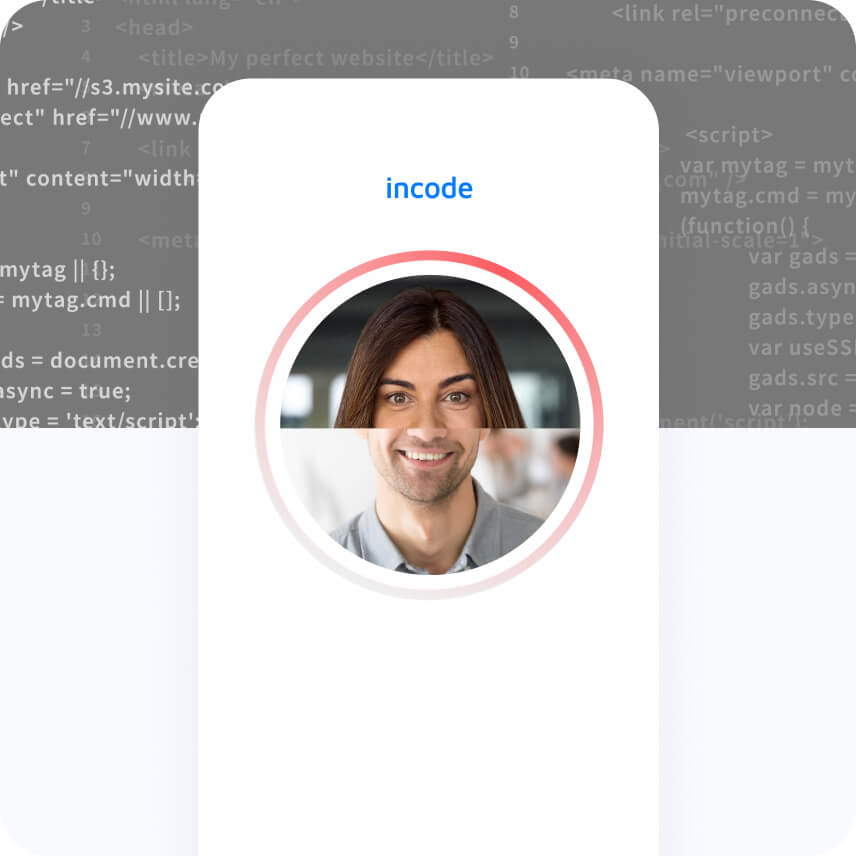

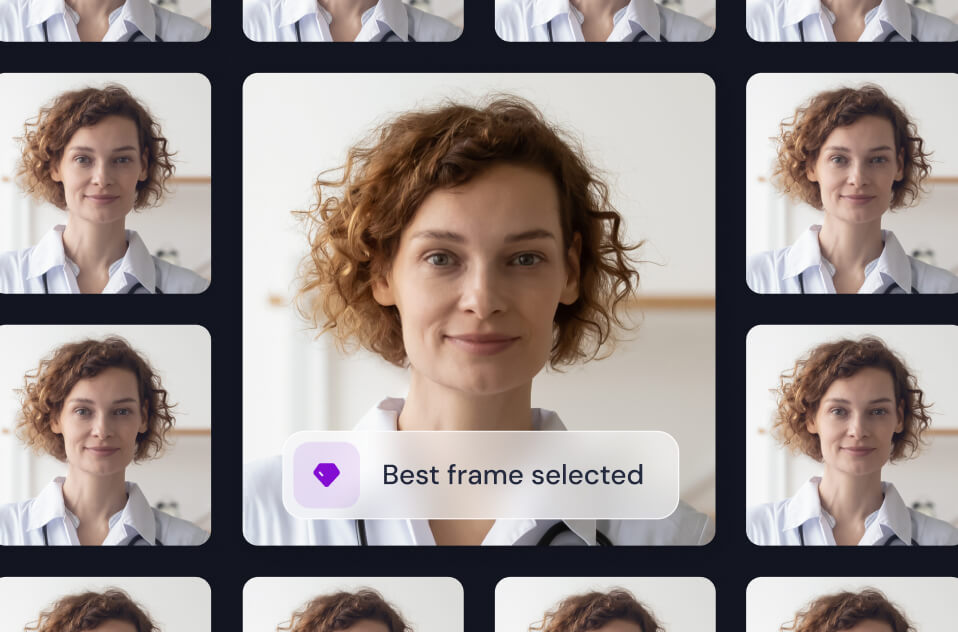

Visionary digital and physical identity

verification and spoof detection

We own and develop our fraud detection tech, giving us a faster edge in tackling

emerging fraud methods.

IDV

Screen and Paper ID Liveness: AI vs Humans

⬤ Consistent improvement

Our AI has evolved across versions, achieving superior accuracy in detecting liveness for both Screen and Paper IDs.

⬤ Outperforming humans

By version 5.0, our models surpass human annotators, including stringent benchmarks like “Consensus 3 out of 5.”

⬤ Unmatched accuracy

Reliable performance across all confidence levels ensures precision beyond human capabilities.

⬤ Proven trust

Cutting-edge technology ensures fraud detection that’s faster, smarter, and more accurate than ever.

Unmatched Detection Rate

Digital Spoof Check

⬤ Our solution

99.6% digital spoof detection with close to 0% false rejections.

⬤ Widely recognized solutions

Leading names in the industry reach only 67% accuracy with much higher false rejections—leaving significant gaps in protection.

⬤ Closest competitor

Detects at 96.3% accuracy but faces higher false rejection rates.

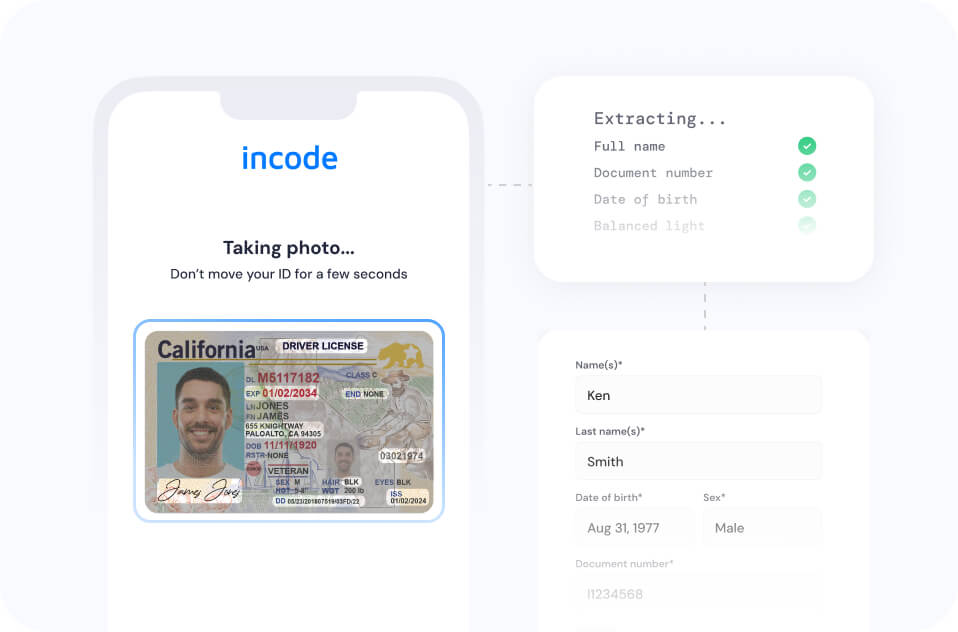

Unmatched accuracy & reliability

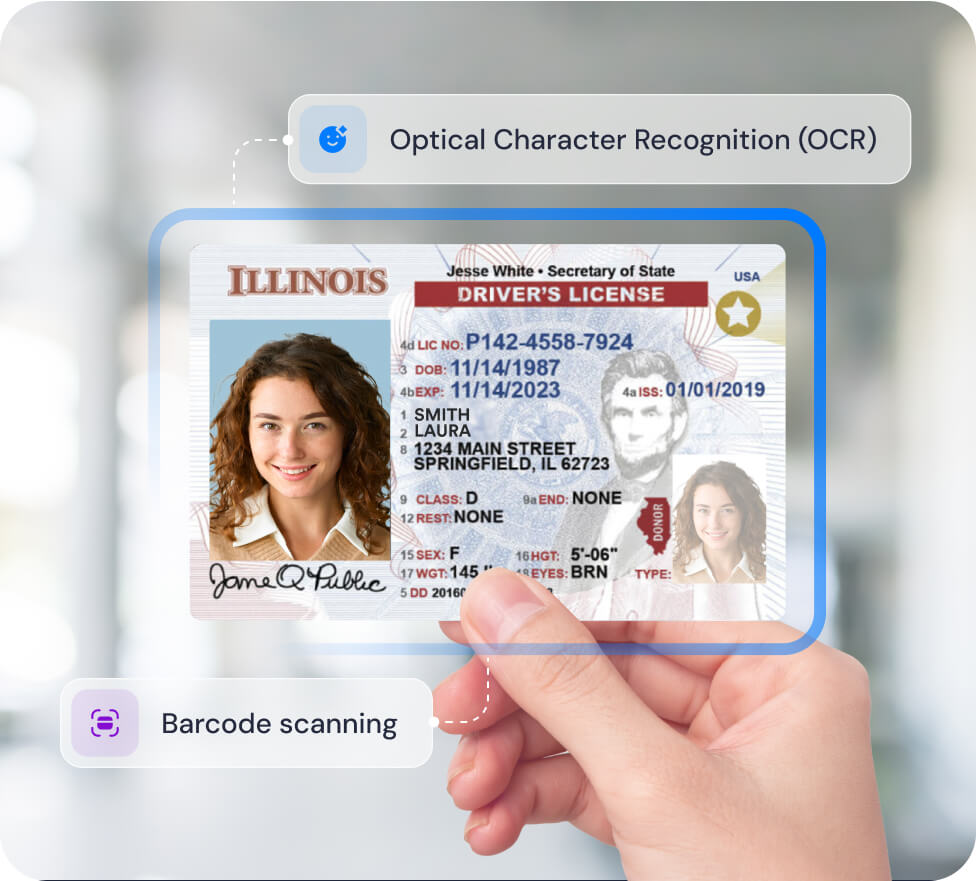

In-House OCR

⬤ 99.4% OCR Accuracy

Our in-house OCR solution outperforms third-party alternatives, achieving a 99.4% accuracy rate compared to 92.5% for leading external providers.

⬤ Enhanced Fraud Detection

Higher accuracy ensures our fraud-related checks deliver reliable, high-value insights, supporting secure and efficient verification.

⬤ Built for Precision

Developed in-house, tailored specifically to our needs, and optimized for fraud detection – our OCR solution sets the standard in accuracy and trustworthiness.

The Fraud Lab

Meet Incode’s In-house fraud team, responsible for initiatives that are unique in our industry and are the

key to staying ahead of emerging fraud and high-performance technology.

Incode’s fraud technology has solved problems

in the most challenging circumstances.

FINANCIAL SERVICES

Fraudulent account

opening

INSURANCE

Coordinated serial

fraud attack