TRANSFORMATIVE IDENTITY VERIFICATION

Empowering global organizations to reimagine a world of trust through fully in-house developed and automated identity verification and authentication.

WHY INCODE

Trusted worldwide by organizations across every industry, Incode’s AI-driven, fully customizable, privacy-centric solutions prevent fraud and onboard instantaneously to offer a seamless customer experience.

First validated liveness detection, fastest user experience

Incode’s LiveBeam is the first ISO 30107-3 compliant passive liveness technology. 50x faster than competitors, LiveBeam accurately reduces fraud and gives your customers a friction-free onboarding experience.

End-to-End

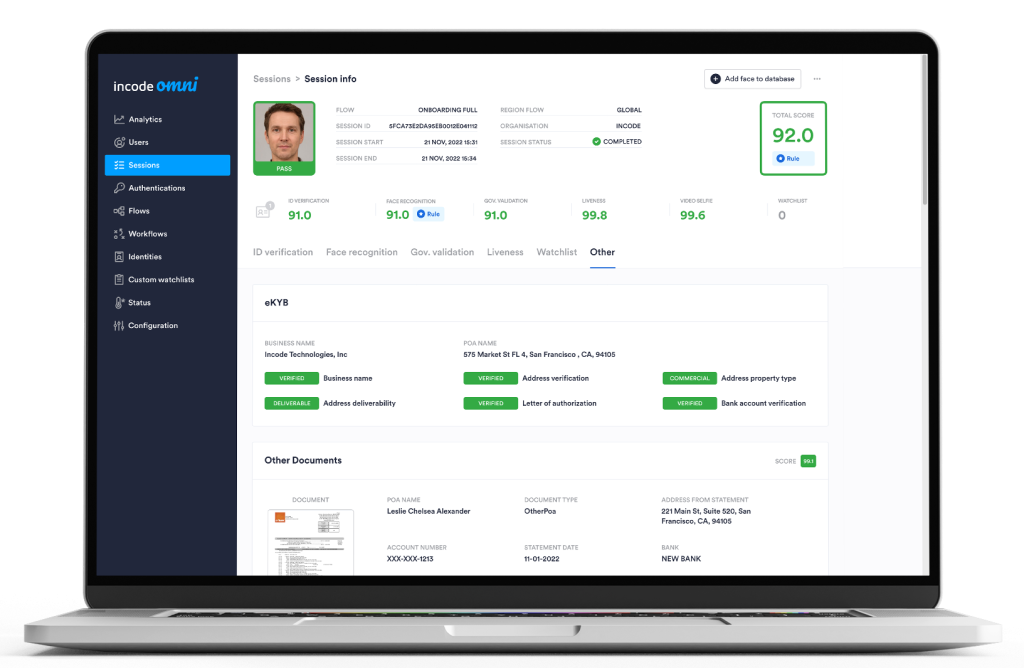

Incode Omni uses ID documents, biometric data, and partnerships with governments and businesses to automate user identity verification (including face capture and ID document capture) rapidly and securely.

Customizable

Accurate, immediate answers with workflows tailored to your business

Fully automated to eliminate manual assessment errors

Best user experience with 40% higher conversion rates

Omnichannel to support all your business needs

CONNECT WITH US

JOIN THE IDENTITY REVOLUTION WITH INCODE OMNI

Incode’s KYB-compliant flagship product, Incode Omni, is an automated, end-to-end orchestration platform.

Global Coverage

Catch terrorists, UBOs, and sanctioned businesses anywhere in the world

Dashboard Metrics

Logging and presentation of KYB session results, including verification of identities and watchlist searches

Rapid Results

Instantly protect your business by confirming the authenticity of companies and UBOs

Trusted Security

Protect against AML losses and government fines for non-compliance

ABOUT INCODE

Reimagine Trust

Incode is the leading provider of world-class identity solutions that is reinventing the way humans authenticate and verify their identity online to power a world of digital trust. Incode’s revolutionary identity solutions products are unleashing the business potential of universal industries including the world’s largest financial institutions, governments, retailers, hospitality organizations, and gaming establishments by reducing fraud and ultimately, transforming human interactions with data, products, and services.