Top companies switch to Incode for our proven impact on fraud protection and growth

KYC/AML isn’t just a compliance checklist

It’s preventing fraud unique to the markets in which you operate – ensuring your security, compliance, and growth objectives are not just met, but guaranteed.

Leverage intelligent automation for continuous AML vigilance throughout the customer lifecycle

Low-risk, low-friction

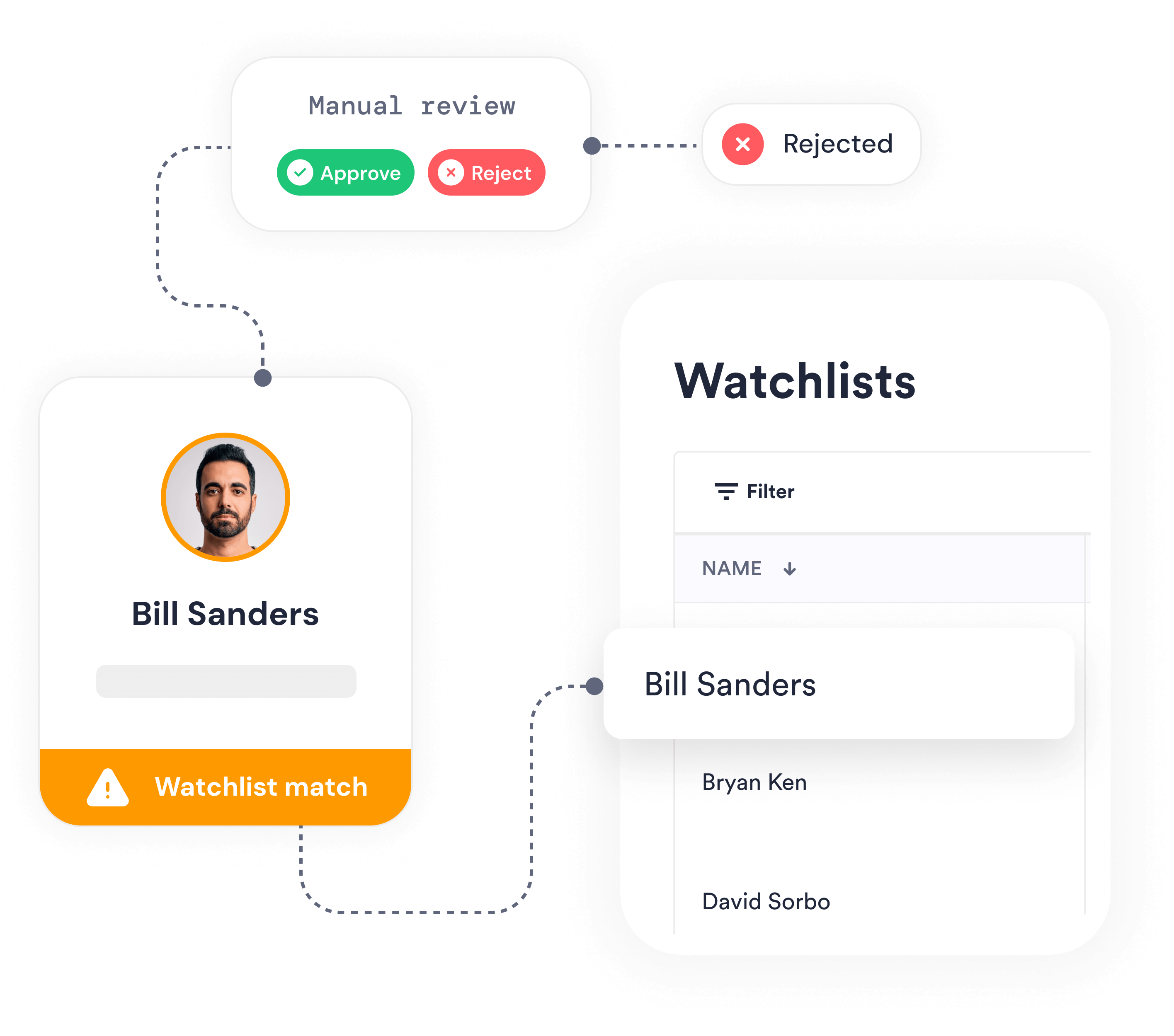

Conditional logic automatically routes users to the appropriate verification flow based on your established risk criteria.

Ongoing monitoring

Set up recurring screenings for high-risk transactions and to ensure your risk assessments are up-to-date.

Auditable KYC/AML records

Easily maintain and access historic verification data and decision points for compliance purposes.

KYC/AML approach adapted to your specific business needs

Screen against up to 100+ global sanctions lists, 5000+ PEP lists and global adverse media lists for comprehensive compliance and business security

Powering KYC/AML compliant growth with secure and efficient onboarding

How AML screening works