In the financial services industry and in other industries that depend upon financial transactions, “eKYC” stands for “Electronic Know Your Customer” or “Electronic Know Your Client.” It is an electronic type of “Know Your Customer” (KYC) implementation.

Whether conducted electronically or non-electronically, KYC performs three critical tasks for businesses:

- Verifies the identities of customers.

- Confirms the authenticity of transactions.

- Assesses the risk of a particular application, login, or transaction.

If a business does not truly know its customers, the business is at risk for fraud, government fines and penalties, and other significant types of financial losses.

To guard the business, an eKYC solution checks identity not only when a potential customer applies for an account, but throughout key moments in the customer life cycle, such as when processing and authorizing transactions, when considering whether to renew accounts, and when considering whether to increase credit lines.

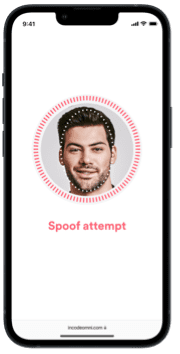

The identity checks in an eKYC solution need to be robust and need to guard against many types of fraud. For example, the solution needs to detect when an applicant tries to spoof the biometric check process and provide a warning when a spoof attempt is detected.

These are just a few of the issues a business faces when selecting an eKYC solution. Would you like to learn more about critical eKYC capabilities?

Incode’s latest white paper, “Three Best Practices for Implementing an Electronic Know Your Customer Solution,” delves into the details of what a superior eKYC solution should contain. The white paper explores why an eKYC solution is necessary for financial services institutions and the capabilities that an eKYC solution must incorporate. The white paper also discusses:

- The relationship between Know Your Customer (KYC) and Anti-Money Laundering (AML).

- Four methods to identify individuals.

- The consequences of failing to implement an eKYC program.

- The types of institutions that must implement an eKYC program.

- Examples of the worldwide regulations governing KYC.

- How to verify applicant identities securely and rapidly.

- How to assess the risk of applications securely and rapidly.

- How to authenticate enrolled users.

To download this white paper, complete the form below: