KYC/AML Compliance

Ensure compliance with AI-powered KYC/AML verification

Increase conversion, stop fraud, and secure your business compliance at every touchpoint of digital identity interactions. Verify identities, assess risk, automate next steps, and generate reports in real time.

4 seconds

average verification time

98%

users validated on the first try

Top companies choose Incode for our proven fraud protection that drives growth

Compliance first

The pillars of KYC/AML

Lay the foundation for fraud prevention and regulatory alignment with a solution designed for global compliance, easy integration, and risk-based automation.

Immediate compliance

Stay compliant from day one with local and global Know Your Customer (KY) and Anti-Money Laundering (AML) regulations. Incode’s flexible framework adapts to current requirements and evolves in response to new regulations.

Adaptive risk due diligence

Tailor and run customer due diligence for every case and business need, powered by global data connections and dynamic verification flows that assess risk for each user.

Continuous monitoring and auditability

Schedule recurring screenings for high-risk transactions, monitor activity in real time, and maintain auditable KYC and AML records to keep assessments current and simplify regulatory audits.

The Incode Difference

End-to-end KYC/AML compliance built for growth

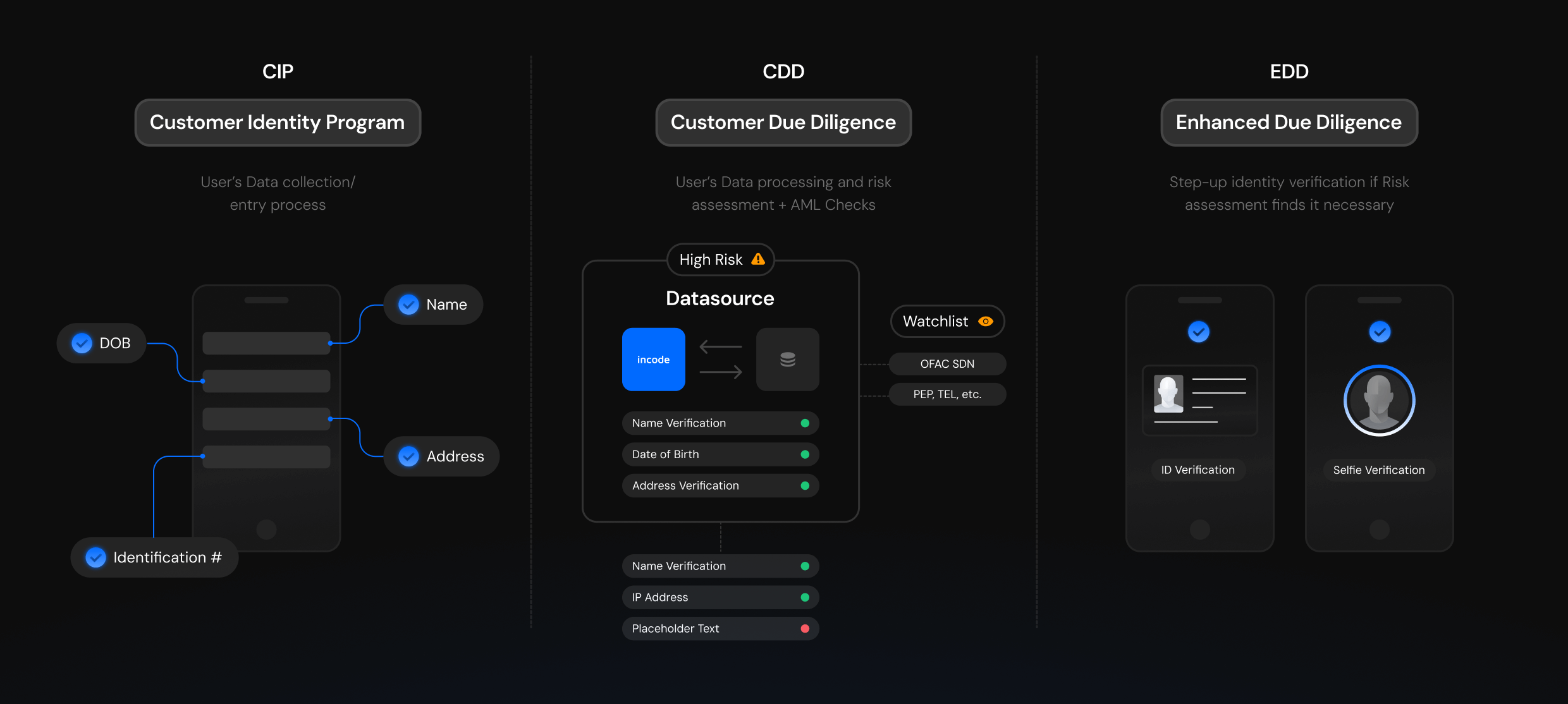

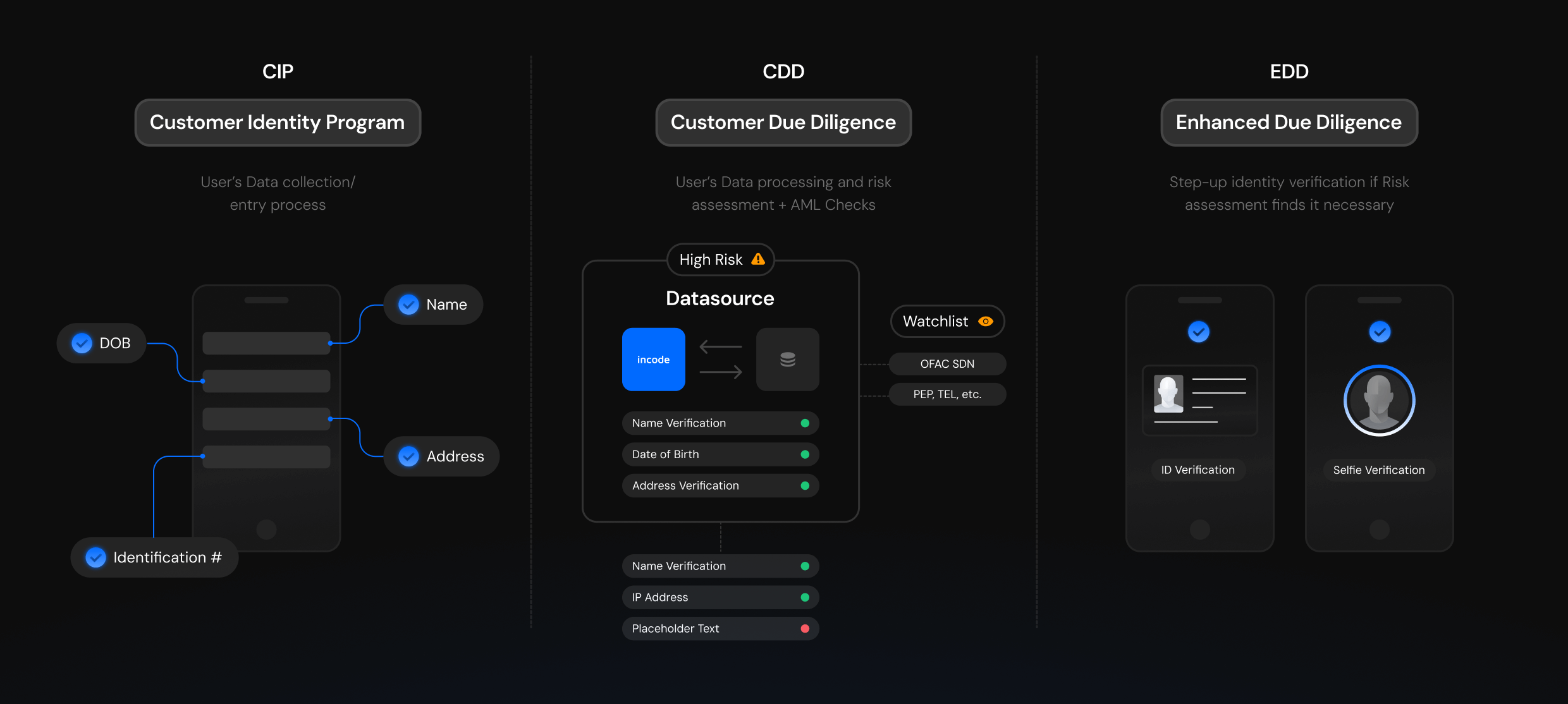

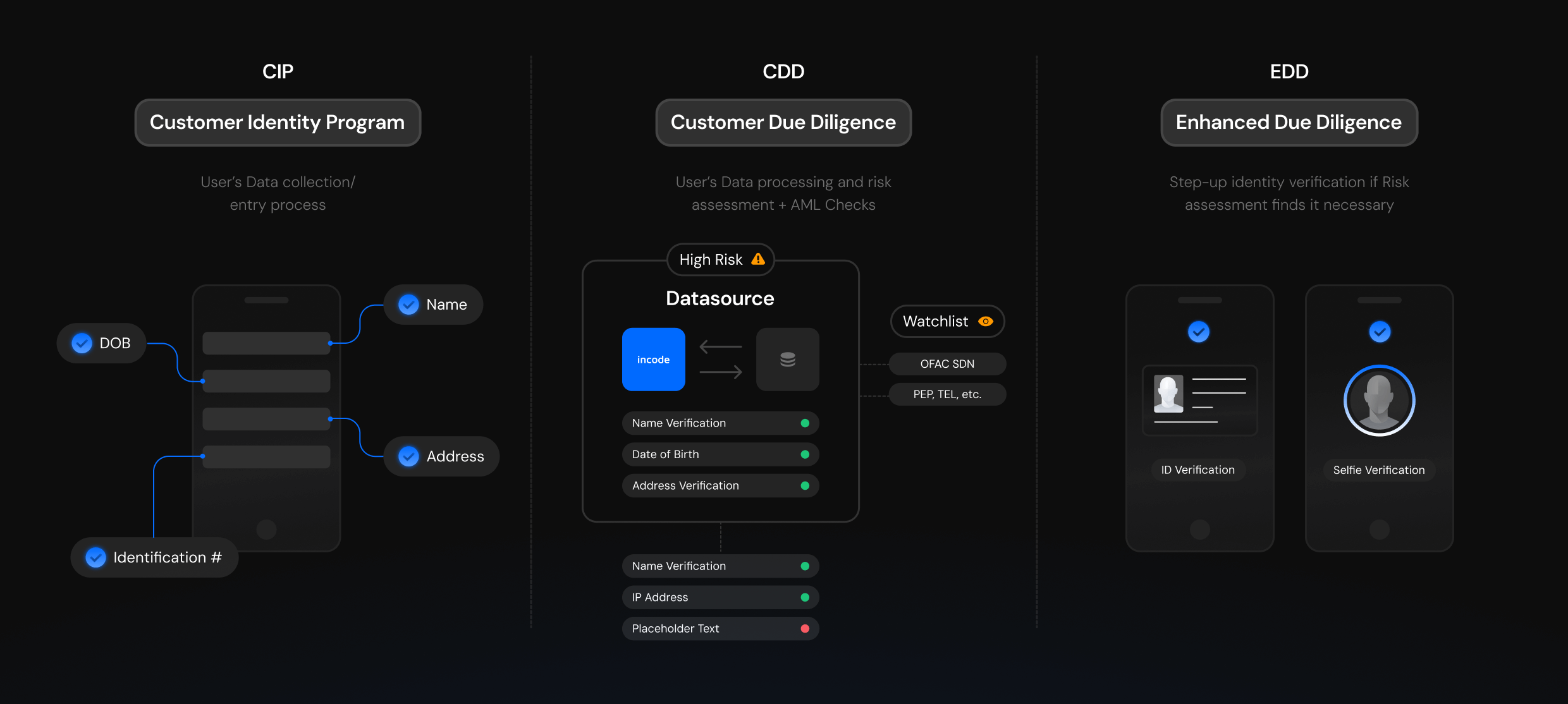

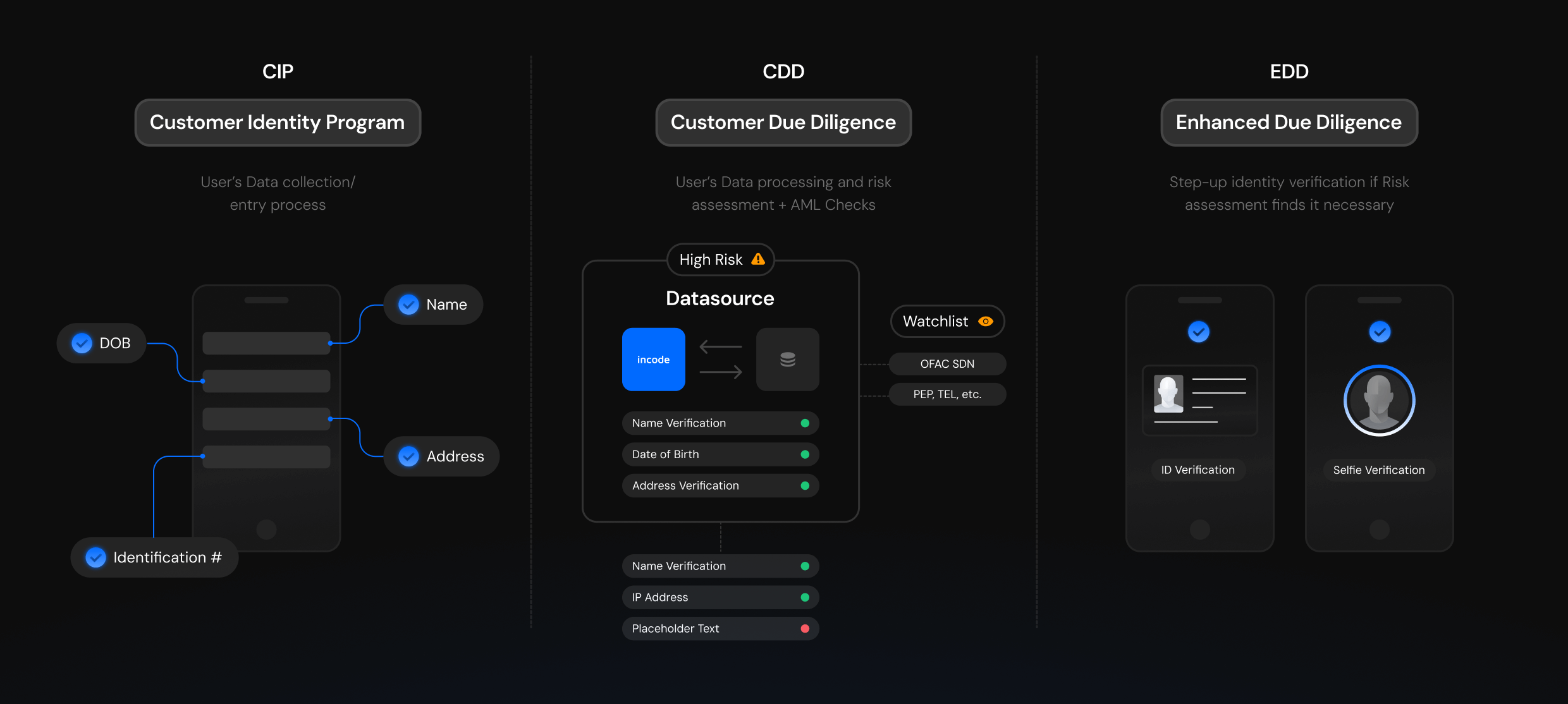

Incode unifies CIP, CDD, and EDD into a complete KYC/AML flow, compliant with BSA and global AML standards.

Customer

Identification

(CIP)

Collect and validate essential customer information such as name, date of birth, address, and ID numbers, or data required by local regulations.

Customer

Due Diligence

(CDD)

Run AML checks, process data, and obtain a holistic view of risk using sanctions and PEP lists, advanced name matching, device intelligence, and behavioral signals.

Enhanced

Due Diligence

(EDD)

Automatically trigger step-up verification with document validation and biometric checks whenever high-risk users are flagged.

Complete

end-to-end

compliance

Meet BSA requirements in the U.S. and align with AML/KYC regulations worldwide, all in one seamless, automated flow.

Demo

KYC and AML compliance

Discover how our solution helps your business with local and global compliance.

Holistic KYC and AML

End-to-end KYC and AML compliance solutions that safeguard trust, drive growth, and maximize conversion across the customer lifecycle.

Stop fraud before it reaches your business. Incode’s AI-powered platform helps you stay ahead of evolving threats, streamline KYC/AML compliance, and unlock exponential growth through frictionless identity experiences at every touchpoint.

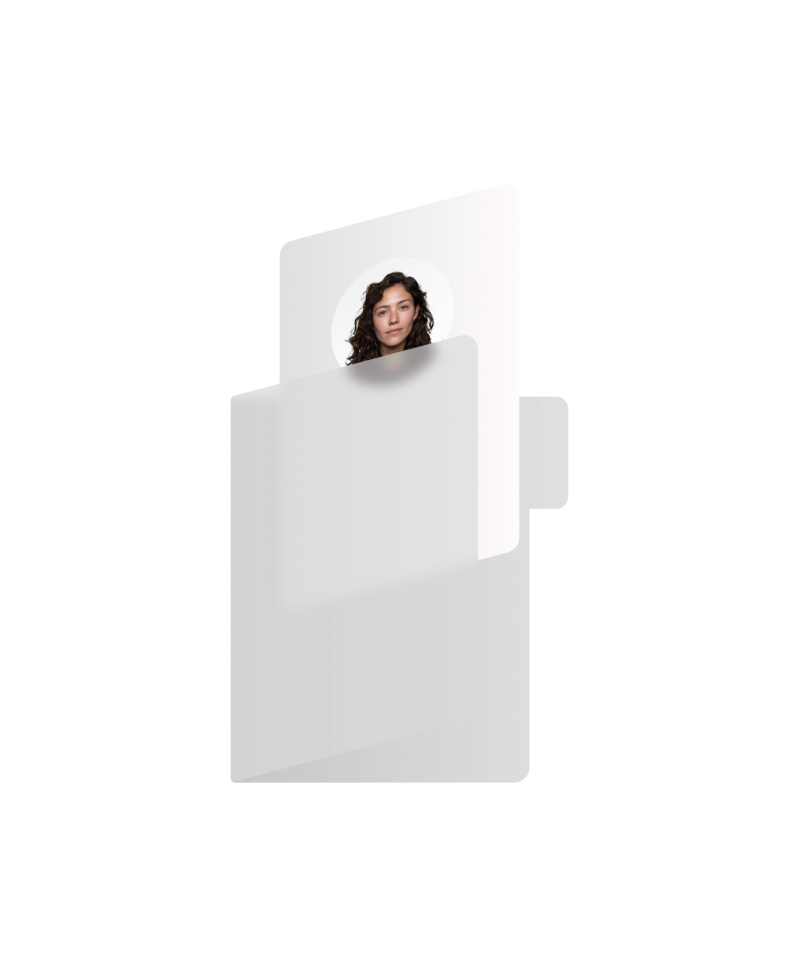

Customer identification and verification

Customer identification and verification

Establishes the customer’s identity using government-issued documents, biometric checks, or non-document methods in line with regional compliance standards.

Incode offers advanced identity verification technology for data verification, document authentication, passive liveness detection, and face biometrics in a single automated flow.

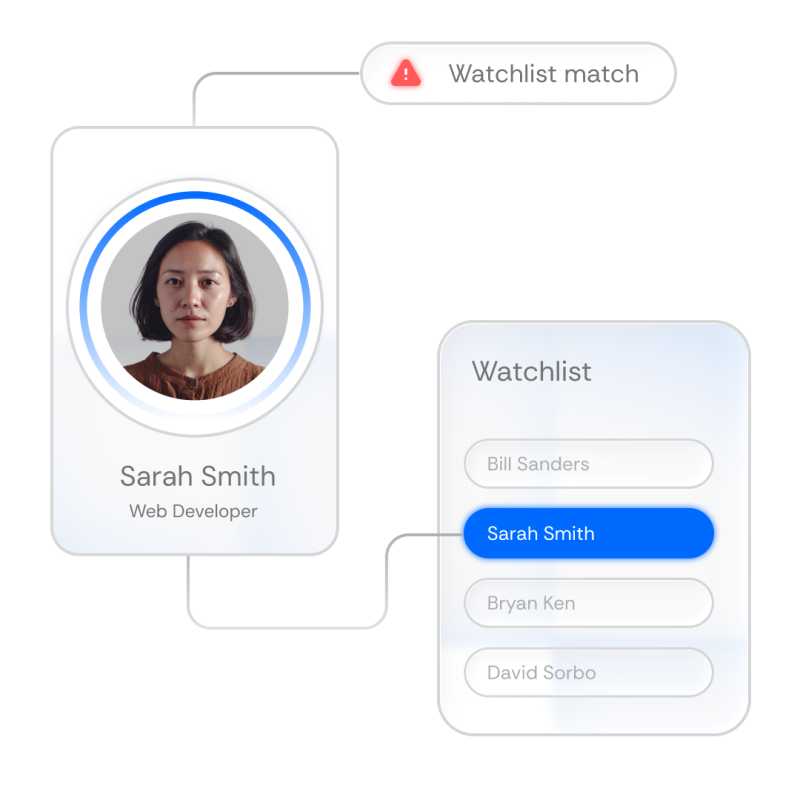

AML screening and risk assessment

AML screening and risk assessment

Real-time screening against 100+ sanctions lists, 50K+ PEP records, and global adverse media, combined with device, network, and behavioral risk checks.

Incode applies AI-driven scoring and advanced name matching to detect anomalies and reduce false positives in real time.

Ongoing monitoring and escalation

Ongoing monitoring and escalation

Ensures continuous compliance by re-screening customers, monitoring transactions, and escalating high-risk cases for enhanced due diligence.

Incode automates periodic checks, triggers step-up verification when risk rises, and adapts flows dynamically to evolving regulations.

Audit-ready compliance and reporting

Audit-ready compliance and reporting

Maintains complete records of verification data, decisions, and actions for regulators and internal audits.

Incode provides a centralized dashboard, audit trails, and automated SAR/STR reporting to simplify compliance operations globally.

Flexible integration and deployment

Flexible integration and deployment

Supports seamless implementation through SDKs, APIs, and web integrations tailored to your infrastructure.

Incode enables fast, developer-friendly deployment with minimal engineering lift and scalable architecture for global rollouts.

Leading global enterprises choose Incode

Enterprise-grade security and compliance

Resources

Latest resources on KYC and AML compliance

Get in touch

Ready for the next generation of KYC/AML solutions?

Ensure compliance, stop fraud, and grow faster with Incode’s all-in-one verification platform.

Contact Us