Financial Services

Secure every transaction with advanced fraud protection

AI-powered identity verification that stops sophisticated attacks while ensuring compliance and frictionless customer onboarding.

Leading global companies choose Incode for identity verification

We verify identities for

4.1B+

Identity checks in 2024

8 of the top 10

Banks in the United States

4 of the top 5

Banks in Latin America

3 of the top 3

Global neobanks

Financial institutions

face a new era of fraud

Generative AI has created emergent threats that legacy security systems can’t contain.

96.4% of financial services professionals consider deepfake and synthetic identity fraud to be a top-of-mind concern.

Source: Incode Survey

Deepfake incidents increased

700% in the fintech sector in 2023 alone.

Source: Deloitte

Critical fraud challenges for the financial industry

AI-powered fraud at scale

Criminals use generative AI to create convincing deepfakes and synthetic identities that bypass outdated identity verification.

Complex compliance demands

Evolving KYC/AML requirements across jurisdictions while managing new reimbursement mandates and data sharing regulations.

Security versus experience trade-offs

Financial institutions struggle between rigorous verification that frustrates customers and fast onboarding that opens security gaps.

Incode’s technology

Core benefits for financial institutions

Incode empowers financial institutions across banking, fintech, loans and payments, crypto, insurance, and investment.

Streamlined onboarding

- Liveness Detection

- Facial Recognition

- Document Verification

Regulatory compliance

Manage evolving compliance requirements with dynamic workflows and government-sourced KYC/AML verification.

- Customer due diligence (CDD) and enhanced due diligence (EDD) processes

- Global watchlist, sanctions, and PEP screening

- Compliance readiness across 190+ countries

Advanced fraud detection

Prevent unauthorized access and protect sensitive health data from AI-driven fraud attacks.

- 99.4% OCR accuracy

- 99.6% accuracy in detecting digital spoofs

- 35+ AI models trained on the latest fraud attacks

Reduced costs and enhanced trust

Lower costs by reducing manual intervention and human error, while strengthening customer confidence.

- Risk-based verification with adaptive workflows

- Smarter document verification

- Privacy by design that builds patient trust

See how Incode can transform your financial services company

The Incode Difference

Why financial services organizations choose Incode

We combine in-house AI technology, compliance expertise, and strength in the world’s most challenging fraud environments to deliver superior security and growth.

Innovation and adaptability

Innovation and adaptability

Internally developed tech to stop fraud, including facial recognition, document verification, liveness detection, and advanced risk assessment.

Identity verification technology

Identity verification technology

Internally developed tech to stop fraud, including facial recognition, document verification, liveness detection, and advanced risk assessment.

Proven in high-risk markets

Proven in high-risk markets

Our platform is designed to handle the toughest fraud environments worldwide, giving organizations confidence at scale.

Advanced fraud network and data

Advanced fraud network and data

AI that learns continuously from anonymized fraud signals across a global network, strengthening detection with every interaction.

Government-verified biometrics

Government-verified biometrics

Facial biometrics matched directly with official government sources deliver unmatched precision and compliance.

Future-ready threat protection

Future-ready threat protection

Advanced AI protects against emerging threats, such as deepfakes, synthetic identities, and real-time anomalies, before they impact your business.

Proven results that drive growth

Gain higher conversions, faster onboarding, and stronger fraud prevention in one seamless solution for financial services.

Up to

99%

Fraud reduction

Up to

40%

Higher conversion rates

Up to

5x

Faster onboarding

User experience

How it works

One identity for every interaction.

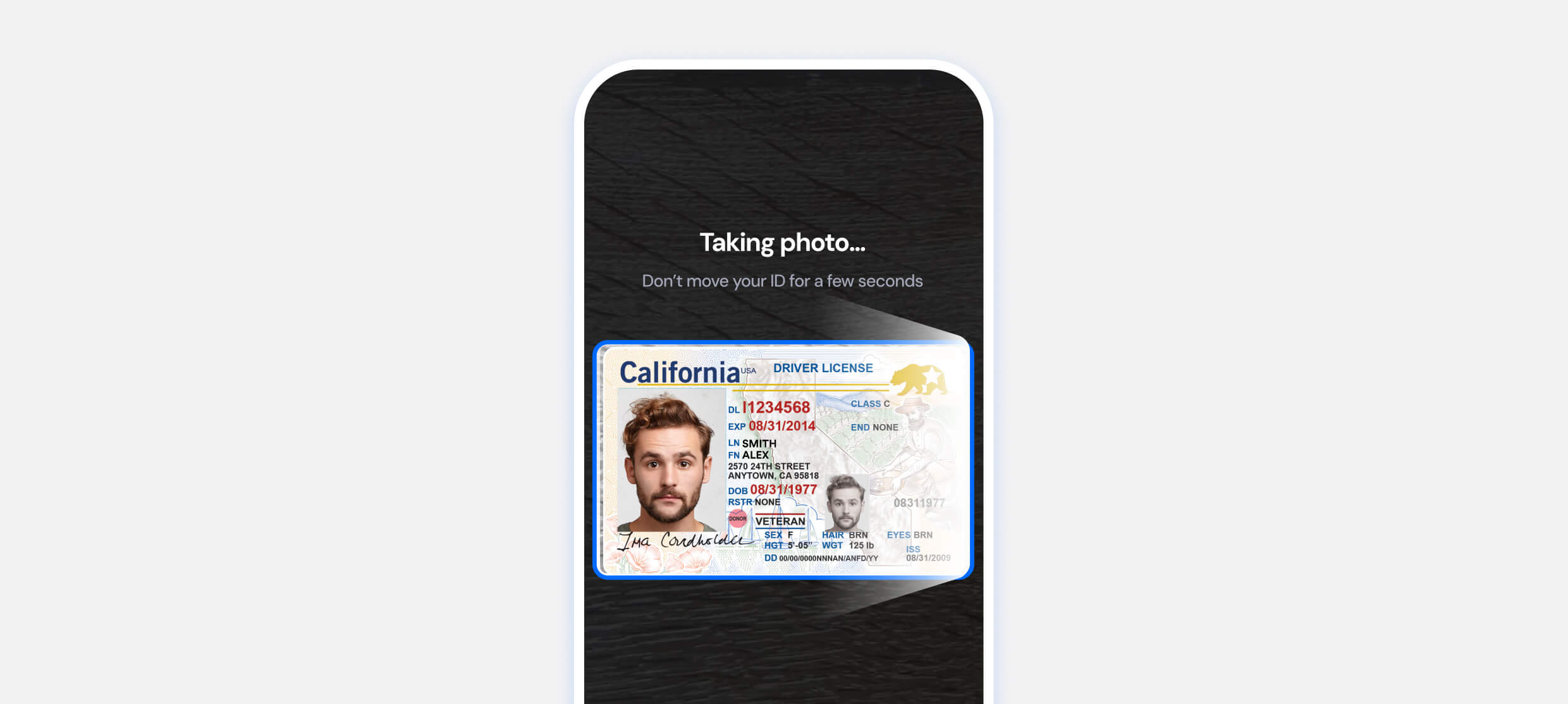

ID capture

The user submits their government-issued ID.

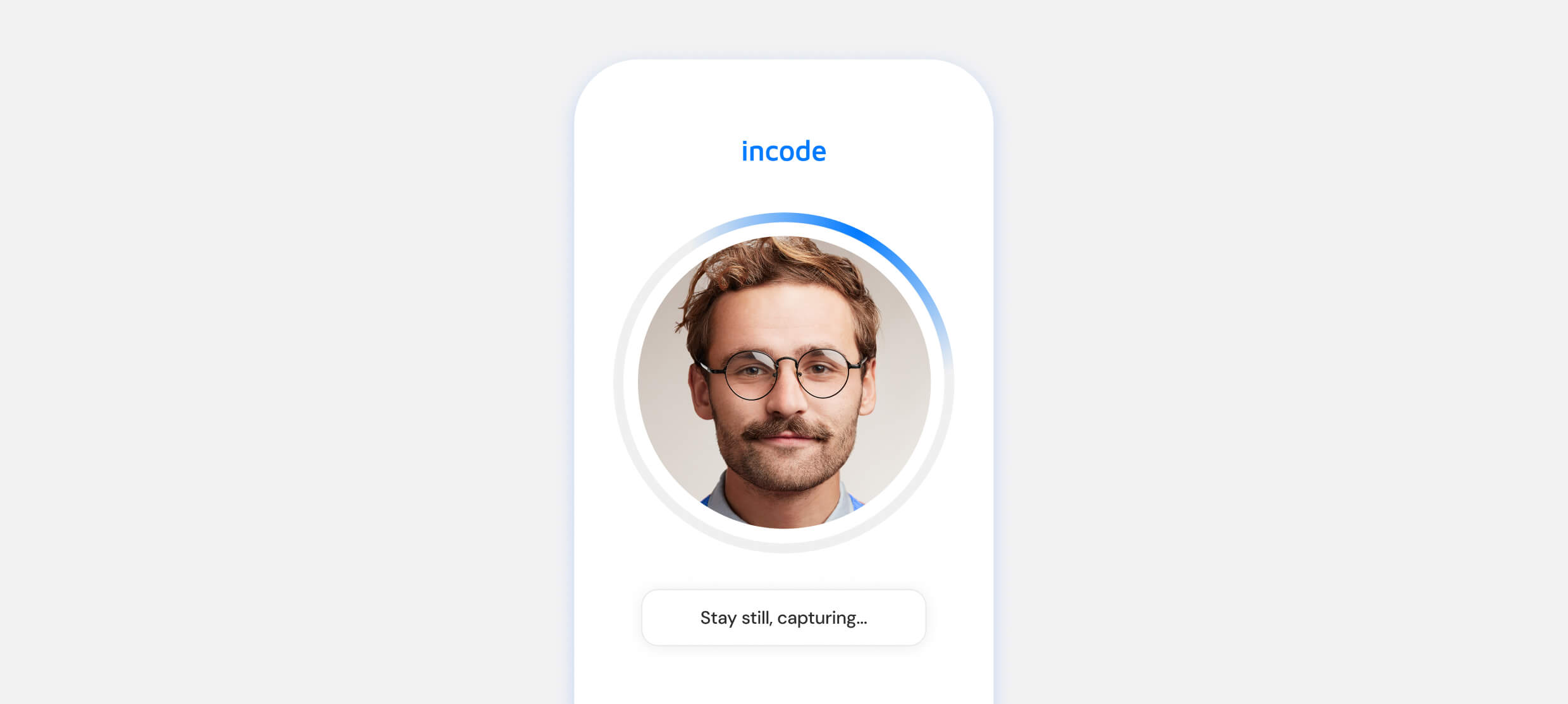

Selfie capture

Incode’s AI verifies liveness and matches the selfie to the ID in milliseconds.

Real-time check

Data is validated against sanctions, watchlists, and trusted government sources.

Account access

Legitimate users are approved instantly, while fraud attempts are blocked before they reach your systems.

ID capture

The user submits their government-issued ID.

Selfie capture

Incode’s AI verifies liveness and matches the selfie to the ID in milliseconds.

Real-time checks

Data is validated against sanctions, watchlists, and trusted government sources.

Account access

Legitimate users are approved instantly, while fraud attempts are blocked before they reach your systems.

Build on trust

Redefining

identity verification

with unmatched AI

technology

Incode sets the standard for speed, accuracy, and security by combining proprietary AI models, deep biometric expertise, and real-world fraud intelligence.

Reaching underserved users at scale required a completely new way to think about identity verification, aligned with our mission and our technology. Incode delivers exactly that.

Luis Ortiz

COO, Klar

Trusted by the world’s leading companies

Enterprise-grade security and compliance

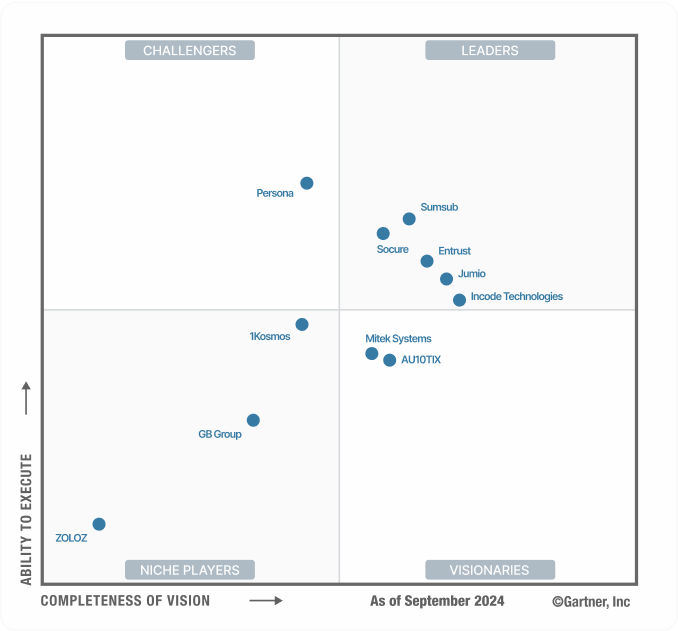

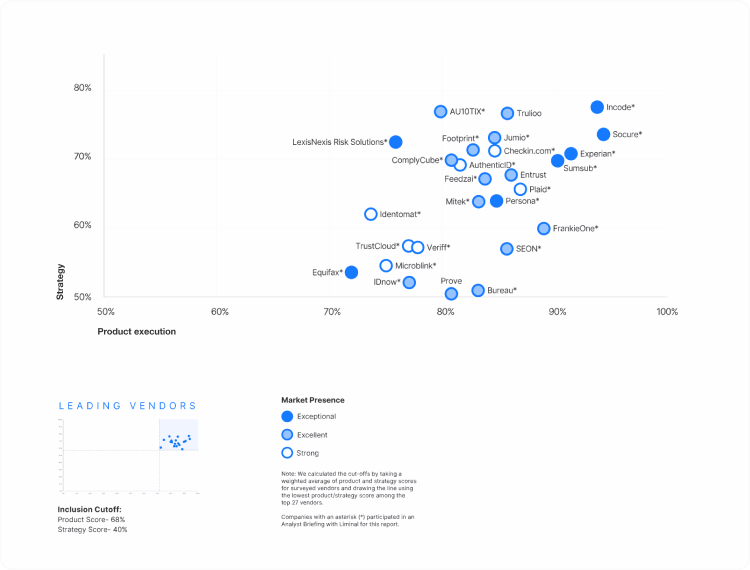

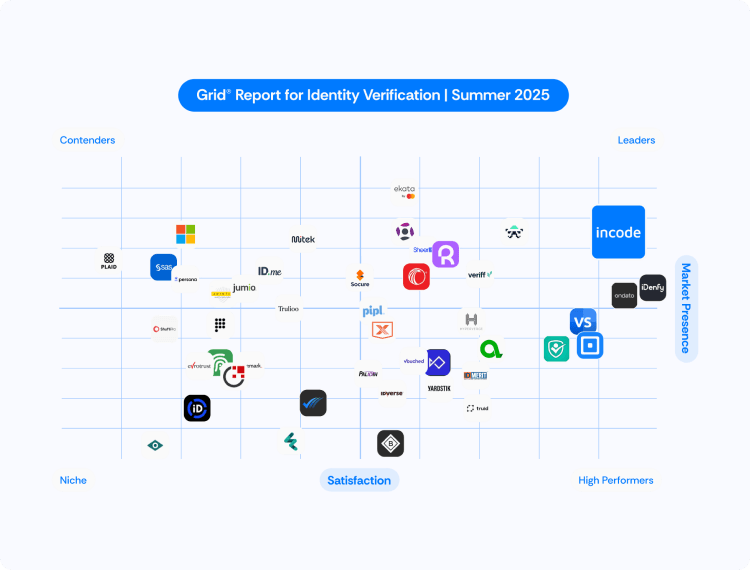

Gartner® Magic Quadrant™ for Identity Verification.